Economists at Genghis Capital Ltd, an Investment Bank, on Monday said Kenya’s budget deficit is estimated to decline at the end of the 2018/19 fiscal year, but expressed concerns over absorption of funds.

In a 2Q19 Macro-Economic & Fixed Income Outlook, the Analysts said the fiscal deficit will decline to 6.0% of gross domestic product at the end of FY2018/19, down from 7.2% at the end of FY2017/18.

“We do not expect the current revenue measures will boost collection in the final quarter, in light of the 15.2% underperformance as compared to pro-rated target (KES 945.6Bn –vs- KES 1.1Tn),” noted the analysts.

This is because the government has maintained its fiscal consolidation stance to restrain the rising deficit and stabilize public debt by enhancing revenue, rationalizing expenditures through zero-based budgeting, and reducing the cost of debt by diversifying funding sources.

Genghis Capital said, however, said the absorption of funds has “Equally been off-tangent, with recurrent and development spending performing at 63.4% and 48.3%, respectively, against a possible 66.7% as at February.”

The National Treasury revised the fiscal deficit upwards to 6.3% from an initial 5.7% estimate.

READ:

- State of Kenyan Economy: Fiscal Consolidation Vs Debt

- Kenya Sets FY2019/20 Budget Deficit to 5.0pc Starting July

*****

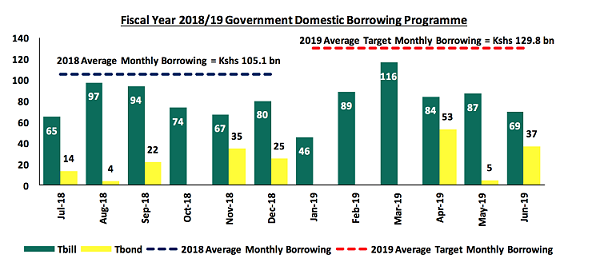

A budget deficit is likely to result from depressed revenue collection, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit.

Despite this, we do not expect upward pressure on interest rates due to increased demand for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities.

Comment from Cytonn Investments Link