M-Pesa Super App, Safaricom’s digital lifestyle app crossed the 4 million downloads within the first three months of launch (July 2021).

Mr Peter Ndegwa, CEO of Safaricom said they have integrated 17 mini-apps and 65 are currently under development with the aim of providing a one-stop solution for their digital consumers.

“We aim to become a digital-first, insights-led organization that enables platforms and ecosystem partnerships. Our digital channels have helped us to improve our consumer digital experiences and empower our micro and SMEs who are the backbone of the economy,” Ndegwa said during the HY 2021/2022 Earnings Presentation.

The M-Pesa App focuses on Safaricom’s mobile banking platform offering an intuitive and interactive solution that simplifies the M-PESA experience by converging several services including buy data, bill manager, M-PESA global, and space where users can save and grow.

“Beyond payments, we are enabling micro and small businesses with products such as bill manager that provides end-to-end solutions like digital invoicing easing their business operations.

During this period we managed a Kshs 2.3 Billion OPEC savings, thanks to initiatives such as smart procurement and planning helping the business to be more efficient while delivering more value to our customers.”

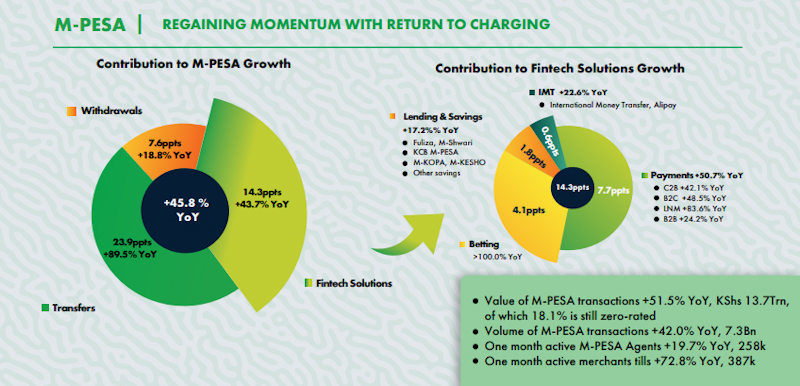

Mr Dilip Pal, the Safaricom Chief Financial Officer (CFO) during the presentation disclosed that M-Pesa accounts for 37.8% of total service revenue from 30.3% in HY 2021 driven by transfers which grew 89.5% year-over-year driven by a return to charging.

The voice comes second at 29.9% and data at 17.1%.

Outlook on M-Pesa App

Safaricom is planning to unleash a slew of new apps, features and development tools on the M-Pesa app to strengthen its connection to customers.

Our fintech solutions continue to be a growth pillar of the M-Pesa ecosystem growing year 43.7% year-over-year. Fintech solutions now account for 32.2% of M-Pesa revenue.

Withdrawals have grown 18.8% year-over-year supported by the improved business environment.

Our strategic priority to be a financial services provider is bearing fruit. Growth in fintech solutions is driven by payments contributing to more than 50% of the growth.

International money transfer continues to perform strongly growing 22.6% year-over-year enabled by the growth in remittances.

Lending and savings have grown 17.2% year-over-year driven by Fuliza.

Looking at M-Pesa this time from the perspective of values and customers, we are delighted to report that customers have grown 7.1% year-over-year to close at 28.7Million.

Customers transacting behaviours influenced by free fees introduced in 20202 have sustained post return to charging.

Chargeable transactions per customer grew 91.9% year-over-year to 18.1 transactions per customer per month from 9.4 transactions in a similar period last year.

Value of M-Pesa transactions continued to grow closing at Kshs 13.7 Trillion up from Kshs. 9 Trillion in a similar period last year.

Bank to wallet transactions remain zero-rated and account for 18.1% of HY22 total value of M-Pesa transactions.

Innovation in digital financial services has been a key growth driver for M-Pesa. We continue to leverage technological innovation to enhance access to financial services for consumers and enterprise customers.

I’m happy to report that we launched a Consumer Super App in July 2021 and now have 3.9Million downloads and 2Million active customers since launch.

We also rolled out the Business Super App and now have 322k organizations currently using the app.

We remain committed to meeting the evolving needs of our customers and merchants through innovation to enhance digital financial services.

The app is available on Playstore for Android users and Apple’s App Store for iPhone users.

Commentary from Mr Dilip Pal.

3 Comments

Pingback: Safaricom to Reward Business Owners on Lipa Na M-Pesa and Pochi la Biashara

Pingback: Future M-Pesa Upgrades Will Take Less Than 15 Minutes

Pingback: Safaricom Unveils ‘Pokea Uteo Wa Furaha’ Christmas Campaign to Reward Customers