Safaricom Plc on Wednesday announced its financial results for its Half Year ended September 30, 2021, and also lowered its full-year forecast for earnings which includes its investment in Ethiopia.

The telco’s initial guidance was 105-108 billion shillings excluded Ethiopia. However, with its revised guidance, its core earnings will range between 107-110 billion shillings.

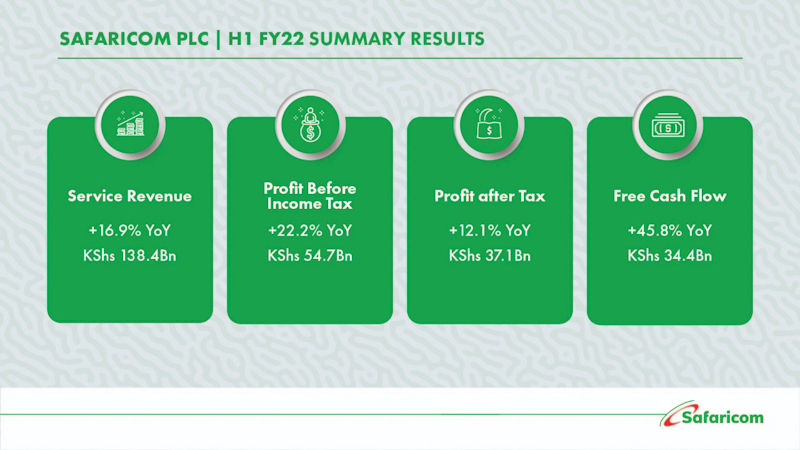

Safaricom said its earnings for the first half surged by more than a quarter to Ksh 57.9 billion. The profit before tax stood at Ksh 54.7 billion, a 22.2 per cent increase compared to FY 2020.

“We are pleased with the solid performance delivered in H1 of the financial year 2022. We remain committed to protecting shareholder wealth and putting our customers first,” said Peter Ndegwa, CEO of Safaricom during a virtual investor briefing.

“During this period, we managed a Kshs 2.3B OPEX savings thanks to initiatives such as smart procurement and planning, helping the business to be more efficient while delivering more value to our customers,” said Ndegwa.

The results were attributed to the strong performance of its mobile financial service, M-Pesa and customer growth.

The outlook of the economy has improved with Kenya staging a partial recovery from a depressed performance last year in view of this and expansion to Ethiopia. We expect earnings before interest and tax in the financial year 2022 to be in the range of KSh 97 to Ksh 100 billion and capital expenditure to be in the range of Ksh 70 billion to Ksh 73 billion inclusive of Ethiopia.

On an underlying basis excluding Ethiopia, we revise our earnings before interest and tax guidance given back in May 2021 from Ksh 105 billion to Ksh 108 billion to the range of Ksh 107 to Ksh 110 billion and maintained the CAPEX guidance given before at Ksh 40 billion to Ksh 43 billion for the financial year 2022.”

Performance Highlights

M-PESA

M-PESA revenue recorded strong performance growing 45.8% YoY in H1 FY22 following the return to charging at the beginning of January 2021.

Total transaction value grew 51.5% YoY to KShs 13.7Trn while the volume of transactions grew 42.0% YoY to 7.3Bn.

M-PESA wallet to bank and bank to M-PESA wallet transactions continue to be free and these account for 18.1% of the total value of M-PESA transactions. Chargeable transactions per one-month active customer grew 91.9% YoY to 18.1 transactions.

Innovation in digital financial services has been a key growth driver for M-PESA.

Mobile data

Mobile data revenue grew 6.3% YoY weighed down by price rationalization, absorbed tax from excise duty adjustment on data from August 2021 and a lapping effect of the accelerated growth recorded in H1 FY21 at the onset of the pandemic in Kenya.

Distinct data bundle customers grew 8.1% YoY to 17.0Mn, data customers using more than 1GB increased 26.7% YoY to 6.8Mn while Active 4G devices grew 37.3% YoY to 9.7Mn. Effective rate per MB declined 27.0% YoY in H1 FY22.

Fixed service and wholesale

Fixed service and wholesale transit revenue grew 21.1% YoY to KShs 5.5Bn supported by 20.1% YoY growth in enterprise revenue to KShs 3.5Bn and 22.9% growth in consumer revenue to KShs 2.0Bn. FTTH customers grew 17.1% YoY to 153.4k while enterprise fixed customers grew 38.3% YoY to 44.9k.

Capital expenditure for the six months ended 30 September 2021 stood at KShs 22.81Bn growing at 0.3% YoY. 4G, 3G and 2G population coverage stand at 95.9%, 96.3% and 96.9% respectively.

Safaricom on Ethiopia Investment: “Opportunities Outweigh The Risks”

1 Comment

Pingback: M-Pesa App's Active Subscriber at 2 Mn: What to Expect from 2.0 Update