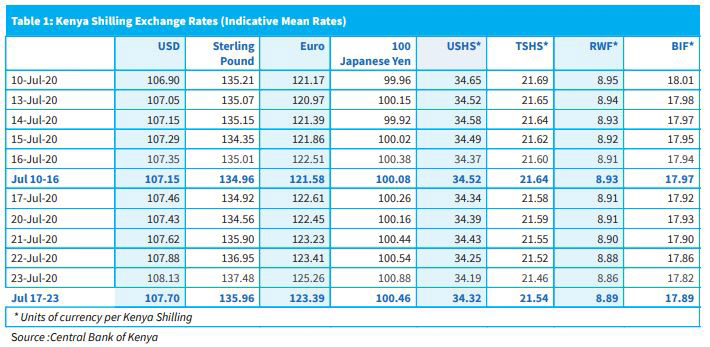

The Kenyan shilling weakened by 0.5 percent to 108.0 against the dollar from Kshs 107.5, recorded the previous week.

This was largely attributed to increased demand for hard currencies by importers who are resuming business after the easing of the pandemic restrictions.

“The Kenya Shilling weakened against major international and regional currencies during the week ending July 23, on account of increased demand for dollars in the interbank market,” said the Central Bank of Kenya.

The Central Bank’s level of forex reserve remains adequate to support the shilling currently at USD 9,421 million (5.72 months of import cover) as at July 23.

The regulator further reported improved diaspora remittances a 12 percent increase to Ksh 31.1 billion in June from KSh27.8 billion in May.

On a year-to-date basis, the shilling has depreciated by 6.6 percent against the dollar, in comparison to the 0.5 percent appreciation in 2019.

READ