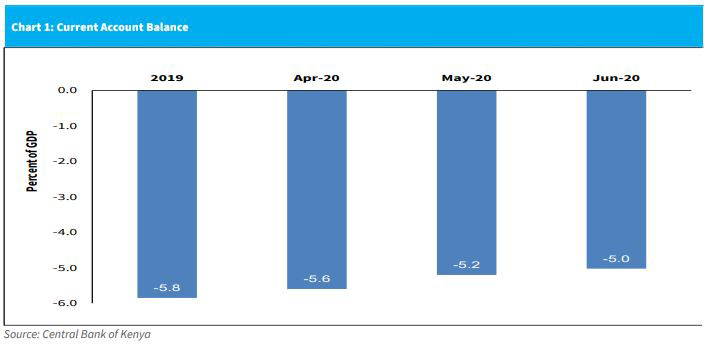

Kenya’s current account deficit narrowed to 5.0 percent in the 12 months to June from 5.2 percent in May, attributed to lower oil imports and improvement in exports of tea, horticulture and remittances.

The Central Bank of Kenya expects the current account deficit to remain stable at 5.8 percent of gross domestic product (GDP) in the year.

“Preliminary data on the balance of payments shows that the current account deficit narrowed to 5.0 percent of GDP in the 12 months to June 2020 compared to 5.2 percent of GDP in the 12 months to May,” said the CBK in its latest weekly bulletin.

To help in sustaining the government’s debt, Cytonn Investments recommends the need to focus on developing certain sectors to build an export-driven economy.

“Encouraging growth in the manufacturing sector will help increase the value of our exports leading to an improved current account. Additionally, they can encourage private sector involvement in such development projects to reduce the strain on government expenditure,” Cytonn said in its Kenya’s Public Debt Focus.

Cytonn says the current account balance worsened to 10.2 percent of GDP in Q1’2020, mainly attributable a 67.0 percent in the services trade balance to Kshs 20.4 billion from Kshs 61.9 billion in Q1’2019.

This was mitigated by the 9.1 percent narrowing in the merchandise trade deficit mainly supported by a 14.0 percent increase in exports, outweighing the 0.1 percent increase in imports.

READ

The country’s growth declined to 4.9 percent in the first quarter from 5.50 percent a year earlier. Projections are that Kenya will be the hardest hit in East Africa.

The IMF forecasts that growth will contract by 0.3 percent, a downgrade from the 1.0 percent growth projection in April.

READ