This content has been archived. It may no longer be relevant

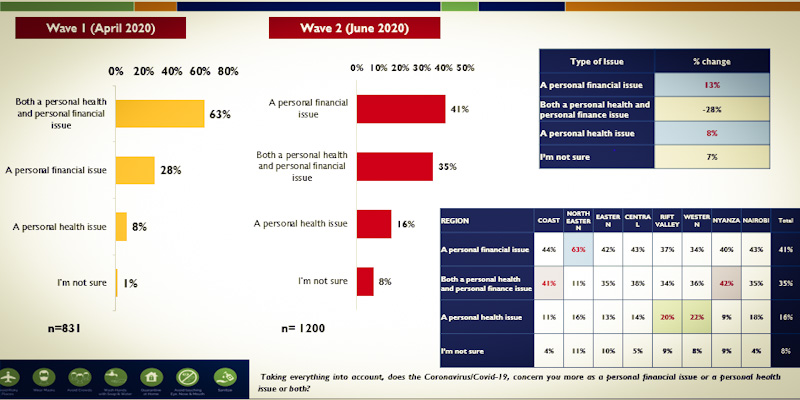

Forty-one percent of Kenyans surveyed by Infotrak Research and Consulting said the COVID-19 pandemic has become a personal financial and second as both a personal financial and health Issue at 35 percent.

Infotrak surveyed 1,200 people over the phone between May 28 and June 2. I largely comprised 69 percent of the respondents from rural areas, 31 percent urban while a quarter was aged 18-24 years.

According to the latest findings released Sunday, COVID-19 is being seen first as a financial issue at 41 percent from 28 percent in April. On the other hand, as both a personal health and finance issue has fallen to 35 percent from 63 percent and as a health concern among Kenyans at 16 percent.

“The problem does not end with the inability to pay for basic necessities; the rent crisis facing most urban Kenyans is real with 63 percent of Kenyans saying they are unable to pay their rent on time and 60 percent saying they are unable to pay their rent in full,” Infotrak said.

“Kenyans are currently faced with a myriad of financial challenges ranging from the high cost of food to the inability to pay for basic needs like housing and utilities.”

READ

Nearly 87 percent of the respondents indicated the cost of food has gone up, 79 percent can no longer remit money to dependents back home while 75 percent can’t pay back loans.

Further, 68 percent of Kenyans report inabilities to adequately source energy including gas kerosene and charcoal, 67 percent can’t pay for utilities such as water and electricity while 67 percent are unable to buy medicine.

Further, the pollsters found out that 81 percent of Kenyans are anxious and stressed about what is happening.

“The psychosocial state of Kenyans is screaming very loudly they are feeling anxious and stressed. They also feel confused, lonely, helpless, and mistreated.”

READ

In May, Kenya’s headline inflation slowed to 5.47 percent, the slowest in seven months, compared to 5.62 percent a month ago underlining slower price increases across various inflation basket items.

The direct and indirect consequences of COVID-19 have not only created twin demand-supply shocks but as well significantly reduced tourism, remittance and capital inflows.

RELATED