This content has been archived. It may no longer be relevant

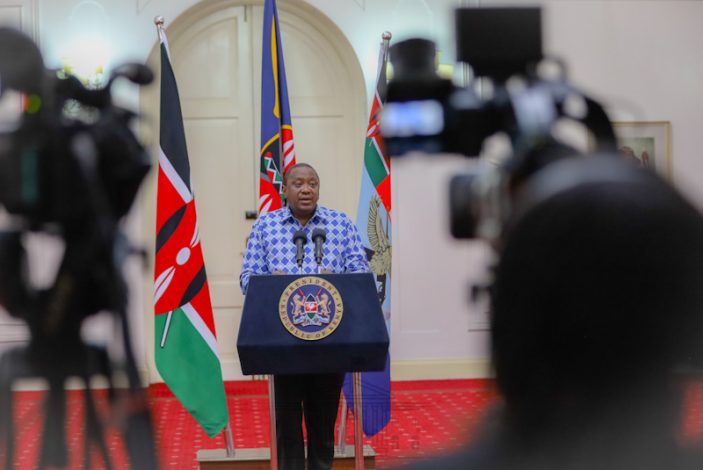

President Uhuru Kenyatta announced measures that will offer relief and increase disposable income to citizens such as tax breaks, employment support, and loan deferment to cushion them against the impact of coronavirus on Wednesday.

“My administration has made and will continue to make targeted state interventions to cushion every Kenyan from the shocks arising from this coronavirus,” President Kenyatta said Wednesday.

I. 100 % Tax Relief for persons earning gross monthly income of up to Ksh. 24,000.

II. Reduction of Income Tax Rate (Pay-As-You-Earn) from 30% to 25%.

III. Reduction of Resident Income Tax (Corporation Tax) from 30% to 25%;

IV. Reduction of the turnover tax rate from the current 3% to 1% for all Micro, Small and Medium Enterprises (MSMEs);

Cash transfer program

V. Appropriation of an additional Ksh. 10 Billion to the elderly, orphans and other vulnerable members of our society through cash-transfers by the Ministry of Labour and Social Protection, to cushion them from the adverse economic effects of the COVID-19 pandemic;

March 21st, when he received Ksh7.4 billion from the Central Bank of Kenya (CBK), he had disclosed that:

“As the government also, we will ensure that our safety net programs, cash transfers to our most vulnerable groups are not only continued but stepped up so that it can also include the urban poor because they are also going to be experiencing a direct negative impact from all of this.”

Data from the Ministry of Labour and Social Protection indicates that as of by February this year there is a total of 1,094,045 beneficiaries -elderly beneficiaries (764,644) and orphans and vulnerable children (295,307).

Kenya Seeks Ksh.116bn from World Bank and IMF for Economic Relief

Suspension of the listing with Credit Reference Bureaus

VI. Temporary suspension of the listing with Credit Reference Bureaus (CRB) of any person, Micro, Small and Medium Enterprises (MSMES) and corporate entities whose loan account fall overdue or is in arrears, effective 1st April, 2020.

The National Treasury shall cause immediate reduction of the VAT from 16% to 14%, effective 1st April,2020;

That all Ministries and Departments shall cause the payment of at least of Ksh. 13 Billion of the verified pending bills, within three weeks from the date hereof. Similarly, and to improve liquidity in the economy and ensure businesses remain afloat by enhancing their cash flows, the private sector is also encouraged to clear all outstanding payments among themselves; within three weeks from the date hereof.

That the Kenya Revenue Authority shall expedite the payment of all verified VAT refund claims amounting to Ksh. 10 Billion within 3 weeks; or in the alternative, allow for offsetting of Withholding VAT, in order to improve cash flows for businesses.

That Ksh. 1.0 billion from the Universal Health Coverage kitty, be immediately appropriated strictly towards the recruitment of additional health workers to support in the management of the spread of COVID-19.

In that regard, I further direct the Ministry of Health, the County Governments and the Public Service Commission to expedite the recruitment process.

Pay cuts

In sharing the burden occasioned by the present global health pandemic, over the duration of the global crisis and commencing immediately, my Administration has offered a voluntary reduction in the salaries of the senior ranks of the National Executive, as follows:

I. The President & Deputy President – 80%;

II. Cabinet Secretaries – 30%;

III. Chief Administrative Secretaries – 30%;

IV. Principal Secretaries – 20%

Central Bank of Kenya Measures:

I. The lowering of the Central Bank Rate (CBR) to 7.25% from 8.25% which will prompt commercial banks to lower the interest rates to their borrowers, availing the much needed and affordable credit to MSMEs across the country.

II. The lowering of the Cash Reserve Ratio (CRR) to 4.25 percent from 5.25 percent will provide additional liquidity of Ksh. 35 Billion to commercial banks to directly support borrowers that are distressed as a result of the economic effects of the COVID-19 pandemic.

III. The Central Bank of Kenya shall provide flexibility to banks with regard to requirements for loan classification and provisioning for loans that were performing as at March 2,2020 and whose repayment period was extended or were restructured due to the pandemic.

Kenya’s Economy to ‘Decline Significantly’ in 2020 Due to Coronavirus – Central Bank

10-hour curfew

The President ordered a curfew in the country from 7pm to 5am, effective Friday.

“This will be in effect to limit the spread of the virus. Together we shall be victorious. We can win this battle. We can and shall defeat the coronavirus pandemic,” said the President.

However, sectors classified as ‘critical and essential’ have been exempted from the curfew. They include Medical professionals and Health Workers, National Security, Administration, and Co-ordination officer, Public Health and Sanitation Officers in the County Governments, Licensed pharmacies and Drug Stores, Licensed Broadcasters and Media Houses, Kenya Power & Lightening Company limited, Food Dealers, Distributors, Wholesalers & Transporters of Farm Produce, Licensed Supermarkets and Hypermarkets, licenses Distributors and Retailers of Petroleum and Oil Products and Lubricants, Licences Telecommunication operators and Service Providers, Licensed Banks, Financial Institutions and Payment Financial Service, Fire Brigade and other Emergency Response Services and Licensed Security firms.

2 Comments

Pingback: Nairobi Ranked 145 Most Expensive City in Globaly: Mercer

Pingback: Kenya’s Covid-19 Cash Transfer Program Lacked Oversight -HRW