This content has been archived. It may no longer be relevant

Stanbic Bank through its Ubunifu Kenya Association has rolled out a free countrywide financial literacy program targeting handcrafters to grow their businesses locally and internationally.

The financial literacy program aims to boost creative businesses inculcate management skills, savings, and investments, managing credit, and debt, insurance, and budgeting across the country under the Ubunifu’s 5-year strategic plan.

Head of Customer Insights and Business Intelligence Stanbic Bank Kenya Grace Mbugua, said through Stanbic Bank’s DADA initiative the bank’s training is aimed at preparing creative businesses for financing opportunities.

“Through the KSh20 billion women-only DADA fund that we launched recently, we have already trained over hundreds of businesses and disbursed over KSh450million worth of financing to small business owners. We are adopting the same approach with the creative entrepreneurs to scale their businesses,” said Mbugua.

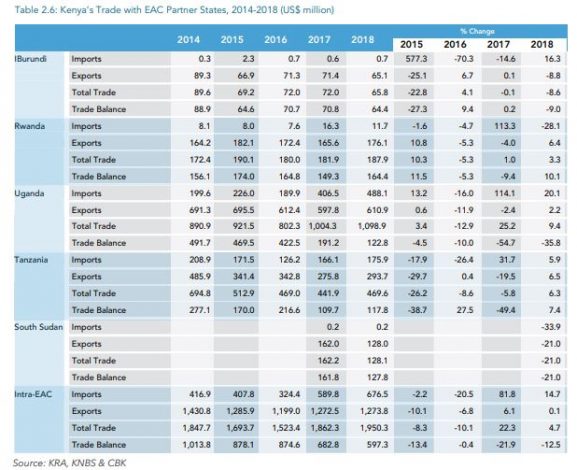

The new development comes even as a new study by the East African Secretariat and TradeMark East Africa revealed that Kenya is quickly losing its position as the East African Community (EAC) exports powerhouse.

“Kenyan products are increasingly finding it tough to compete with cheaper imports from China and India and those produced by regional rivals, shrinking Kenya’s share of exports,” reads the report.

Increase in counterfeits, non-tariff barriers, lack of product diversification and high production cost have also rendered Kenyan products less competitive in the market, Kenyan media reported citing the study.

The study shows Kenya’s exports to Uganda, Tanzania, Rwanda, Burundi, and South Sudan are facing new threats posed by regional manufacturers who are now better equipped in the production of similar products.