The COVID-19 pandemic had a profound impact on Kenya’s economy, disrupting businesses, reducing Gross Domestic Product (GDP) growth, and increasing unemployment rates.

In 2020, the economy contracted to -3% from a rate of 5.0% in 2019 according to the Kenya National Bureau of Statistics (KNBS).

As the country navigated these challenges, the concept of “Build Back Better” emerged as a guiding principle for recovery. This approach emphasized not just rebuilding what was lost but creating a more sustainable, equitable, and resilient economy for the future.

The European Investment Bank (EIB), which is the European Union’s (EU) Bank, has been a key player in supporting Kenya’s economic recovery, providing crucial funding and expertise to help businesses thrive in the post-pandemic era.

EIB’s Role in Kenya

The EIB has a long history of involvement in Kenya, focusing on various sectors in both the public and private spheres such as renewable energy, infrastructure, and small and medium-sized enterprises (SMEs).

Before the pandemic, the EIB had already invested significantly in Kenya, supporting projects that aim to improve the country’s economic landscape since 1976.

Between 2014 and 2020, the EU committed €435 million to support Kenya’s job creation, resilience, and sustainable infrastructure development. Additionally, the EU Emergency Trust Fund for Africa allocated over €58.3 million to Kenya between 2015 and 2019.

However, the pandemic necessitated a more robust response to stimulate the country’s SMEs which were bearing the brunt of the pandemic aftershocks, leading to increased EIB investments to help Kenya recover and build a more resilient economy.

In 2020 alone, the EIB provided EUR 5 billion for new private and public investments across Africa, with a portion of this directed towards Kenya. This funding was crucial in helping Kenyan businesses withstand the economic shocks caused by the pandemic.

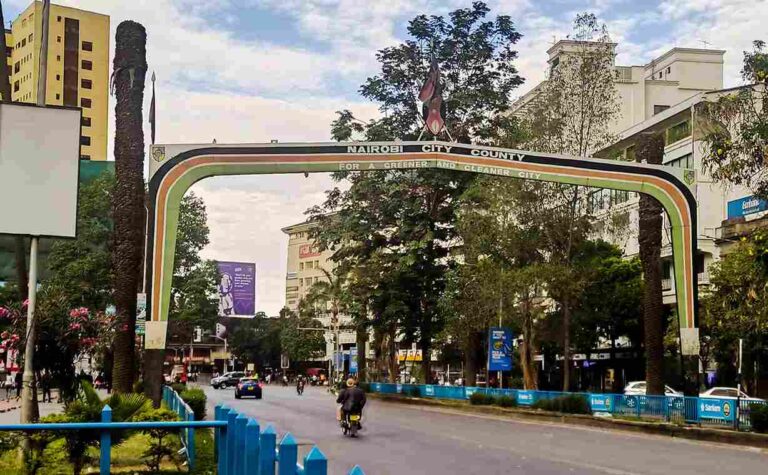

“The EIB will continue to stand by its Kenyan and regional partners because business investment is ever more important in getting Kenya to fully recover from the COVID pandemic and recent economic shocks as well as building a stronger, more inclusive, greener, and digital-led economy,” says EIB regional hub in Nairobi, Edward Claessen.

Intermediated Lending

Intermediated lending involves the EIB providing credit lines to local financial institutions, which then lend these funds to small businesses within their market. These loans are typically focused on mutually prioritized sectors for both the EU and Kenya to maximize impact.

In some cases, the EIB combines loans with grants from the EU to offer comprehensive, affordable financial solutions and technical support or advisory services to both the local banks and businesses. This approach ensures successful business implementation and fosters sustainable enterprise development.

By partnering with local financial institutions, the EIB aims to expand access to credit for a wider range of clients. The EIB’s favourable loan terms, including longer repayment periods, are passed on to borrowers, thus making repayment plans manageable.

Strategic Focus

The EIB’s strategic focus in Kenya includes renewable energy, infrastructure development, and SME support. By investing in these areas, the EIB aims to promote sustainable development, enhance economic resilience, and create job opportunities.

As the Climate Bank, the EIB looks to incorporate climate sustainability in all its operations. For example, the EIB has partnered with the Central Bank of Kenya to unlock climate finance, enabling commercial banks to mobilize funds for climate-related investments.

Case Studies of EIB-Supported Kenyan Businesses

“During COVID and even after people had time to do some planting of flowers and the rest which drove up demand for our flower pots. We had to look for a financial partner that would help us meet the demands of the market,” said Ronald Omwenga, CEO of The Pot Shop, one of the SMEs that received EIB financing support through Co-operative Bank.

“We have grown, and we have been able to help people who want employment to work with us.”

The EIB has played a crucial role in supporting Kenya’s economic recovery, providing essential funding and expertise to help businesses build back better. By focusing on sustainability, equity, and resilience, the EIB’s investments have had a significant positive impact on Kenyan businesses and communities.

Continued support and investment are essential to ensure a sustainable and equitable recovery, enabling Kenya to achieve long-term economic growth and development. This is in line with the Global Gateway Africa-Europe Investment Package which aims to accelerate Africa’s green and digital transformation.

This initiative involves collaboration between the EIB, EU Member States, and other European financial institutions. Together, they will work with African partners to identify and implement transformative projects in priority areas.

RELATED

- From Farmer to CEO: Nancy Nyambura’s Journey with EIB Support

- EIB Boosts Kenyan MSMEs: Empowering Growth After Pandemic

Khusoko is now on Telegram. Click here to join our channel and stay updated with the latest East African business news and updates. Stay connected on your favourite social media channels: Twitter |Facebook |LinkedIn | Instagram| YouTube