![]() Kenya’s central bank has been mulling the official use of a digital currency. More than 60 central banks have already entered the digital currency race since 2014.

Kenya’s central bank has been mulling the official use of a digital currency. More than 60 central banks have already entered the digital currency race since 2014.

No details have been released in Kenya, but the central bank governor, Patrick Njoroge, commented that the bank was working with other global regulators and financial institutions to explore the use of digital currencies.

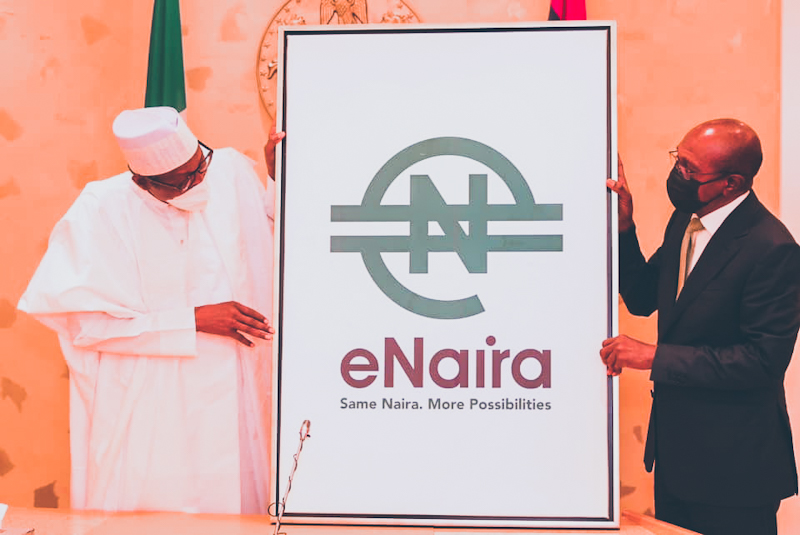

The shift towards digital currencies has been used by some central banks to formulate and implement regulations to manage the use of cryptocurrencies. For example, Nigeria has launched its official digital currency, the eNaira.

The World Economic Forum estimates that a third of Nigerians use or own cryptocurrencies. Kenya is one of the top three markets for Bitcoin, one of the more popular cryptocurrencies.

Cryptocurrencies currently operate as unregulated digital money even though they are accepted and used by the virtual community.

The cryptocurrency market has grown significantly over the past 10 years. This has raised alarm bells because they are distributed directly from one network to the other. This enables participants to interact and confirm payments without involving intermediaries such as banks.

The reason that central banks see the launch of official digital currencies as useful as a first step in regulating cryptocurrencies relates to the fact that both use blockchain technology. A blockchain is a public ledger that allows instant copying, sharing and synchronisation of data across different computers, sites, countries and organisations.

Over 88% of the digital currencies that have been launched use blockchain technology. It also underpins cryptocurrencies.

The launch of a central bank digital currency would mark Kenya’s official entry into blockchain-based digital assets and currencies. But Kenya, alongside many other countries, does not have a framework for managing cryptocurrencies.

Nevertheless, there’s a growing body of evidence that the Kenyan central bank can draw on to design a comprehensive regulatory environment for cryptocurrencies.

We explored the parameters of what a regulatory environment in Kenya would look like in a paper published in 2020. My colleagues and I sought to explain, in-depth, the benefits and challenges of cryptocurrencies and blockchain technologies.

Our analysis was based on the discussion from other parts of the world. Our insights could be used to guide the central bank’s research and adoption of digital currencies.

What’s being done

Though popular, cryptocurrencies are not fully accepted across the world. Some people regard them as scams. In some instances, hackers have managed to steal the currencies and exchange them for legal tender. This is because comprehensive, global governance structures on cryptocurrencies are not yet in place.

The World Economic Forum has recently created a Global Future Council on Cryptocurrencies. The team is expected to evaluate the challenges and opportunities of Central Bank Digital Currencies (CBDCs) and blockchain technologies. The group will also assess what it will take to achieve the key aims of digital currencies.

The World Economic Forum is rooting for the rollout of central bank digital currencies through distributed ledger technology, itself a blockchain technology. The ledger technology gives central banks a toehold into gaining sight of transactions.

The distributed ledger technology, coupled with regulatory oversight, has the effect of cushioning the central banking community from risks linked to receipts, payments, hardware and software systems.

Recommendations

At the moment, the structures for digital currencies have not yet been developed in Kenya. Yet the rest of the world has already ventured into these currencies, and have structures in place in support of the innovation.

The World Economic Forum is developing a central bank digital currency policy toolkit. This is a document that guides central banks on how they can develop digital currencies that suit their monetary policies.

Kenya can make use of the guidelines to create its own official digital currency that doesn’t compromise its monetary policy and financial stability. In addition, a central bank digital currency would need to coexist with, and complement, the existing notes and coins.

The Central Bank of Kenya is a reputable organisation that demonstrated objectivity and care to its entire citizen by warning them about cryptocurrencies. However, with the trend of stable coins and piloting of central bank digital currencies around the world, the government should actively engage in research on these digital currencies and provide a framework around these technologies.

Novel transactions

With the use of blockchain technology, a central bank digital currency can be developed that would open the door to transformational innovations. Businesses and individuals can use them to add novel transactions to the existing chain of activities. And, because blockchain encourages direct sharing of a network in which an individual can interact and confirm payments without contacting any intermediary, it could boost financial inclusion in Kenya.

The adoption of digital currencies will change the financial market and improve the money transfer landscape in the eastern African region. It’s no surprise therefore that the Governor of Tanzania’s Central Bank Florens Luoga has also just announced that the country plans to launch its own digital currency soon.![]()

Dorothy Muthoka-Kagwaini, Deputy Registrar & Senior Lecturer, School of Economics, Daystar University. This article is republished from The Conversation under a Creative Commons license. Read the original article.

2 Comments

Pingback: P2P Exchange Localbitcoins Unveils Mobile App

Pingback: We Need to Know the Functionality of CBDCs Before Introduction - CBK