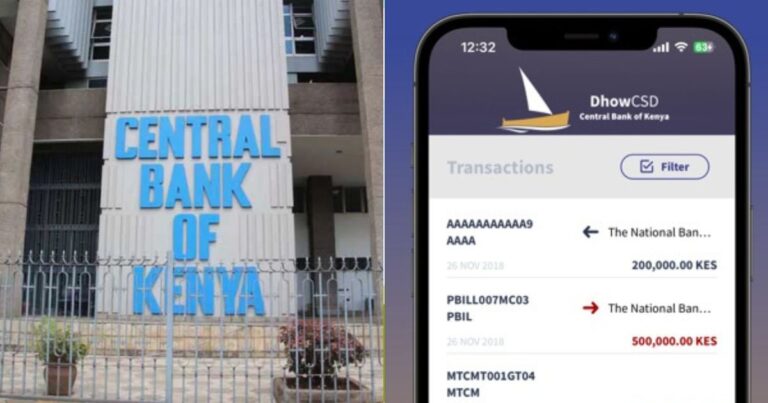

The Central Bank of Kenya (CBK) has rolled out a new feature on its DhowCSD platform that allows investors to pay for successful bids in government securities directly through their mobile phones.

Mobile Payments Through M‑Pesa

CBK announced that investors can now make payments of up to Ksh250,000 via M‑PESA, accessible under the “Transactions” tab in the DhowCSD mobile app or online portal.

Currently, M‑PESA is the only supported option, but CBK confirmed that additional mobile payment channels will be introduced in the future.

You can now pay for your successful Government securities bids directly from your mobile phone for amounts up to KES 250,000 pic.twitter.com/0lohPShSlW

— Central Bank of Kenya (@CBKKenya) November 21, 2025

What is DhowCSD?

Launched in 2023, DhowCSD is CBK’s digital platform designed to simplify access to government securities for retail investors in Kenya and abroad. Through the system, users can:

- Participate in Treasury Bill and Treasury Bond auctions

- View auction results and payment instructions

- Monitor upcoming corporate actions

- Access portfolio statements

- Place secondary market and pledge instructions

How to Register for DhowCSD

To use the platform, investors must first open a DhowCSD account. Registration requires:

- Valid email address and mobile number with a Kenyan operator

- Kenya Revenue Authority (KRA) PIN

- Settlement bank details

- Passport‑size photo and identification (ID, passport, or alien card)

Applicants may also submit a tax exemption certificate if applicable. CBK requires registration to be completed within seven days; incomplete profiles are automatically deleted.

Once approved, users receive a username by email. Joint accounts can be created after each participant has an active individual profile. Any changes to settlement details or email addresses must be processed directly by CBK.

Investing in Government Bonds

After approval (typically two to three days), investors can log in to the DhowCSD portal or app to view available securities and place bids using the BUY/SELL option.

- Competitive vs. Non‑competitive bidding: Investors can choose their preferred method depending on risk appetite.

- Bond types available:

- Fixed‑coupon bonds – stable interest rates with semi‑annual payments.

- Infrastructure bonds—tax‑exempt returns, funding national projects.

- Savings development bonds—long‑dated instruments designed to encourage savings.

With the new feature, payments for successful bids can now be settled instantly via M‑PESA, making the process simpler, faster, and more convenient for retail investors.

Why It Matters for Personal Finance

This update lowers barriers for everyday Kenyans to participate in government securities. By enabling mobile payments, CBK is making Treasury Bills and Bonds more accessible, especially for retail investors who may not have large settlement accounts.

Kenya’s Private Equity Moment: Local Vision, Global Leverage