StanChart Kenya raked in KES 1.29 billion in 2023 from its corporate and investment banking (CIB) sustainable finance business, marking a tenfold increase compared to KES 129 million in 2022.

This impressive growth signifies the bank’s commitment to financing environmentally and socially responsible projects and clients.

According to the bank’s 2023 Sustainability Progress Report, lending to Corporates and Investment Banking remained the primary driver, contributing over 98% of the total revenue in 2023 (up from 84% in 2022).

The bank also saw a rise in sustainable finance income from this segment, earning KES 500 million in 2023. Revenue grew significantly, reaching KES 790 million from KES 109 million in 2022.

Despite a slight decline, wealth and retail banking contributed KES 14 million to the bank’s sustainable finance revenue.

Standard Chartered Kenya said its commitment to sustainability extends beyond just financial products. It actively participates in carbon trading buying and selling carbon credits to support environmental initiatives.

“We rolled out key sustainable finance products on the deposit side to allow our clients to deploy their cash balances towards sustainable lending linked through the Bank,” it notes.

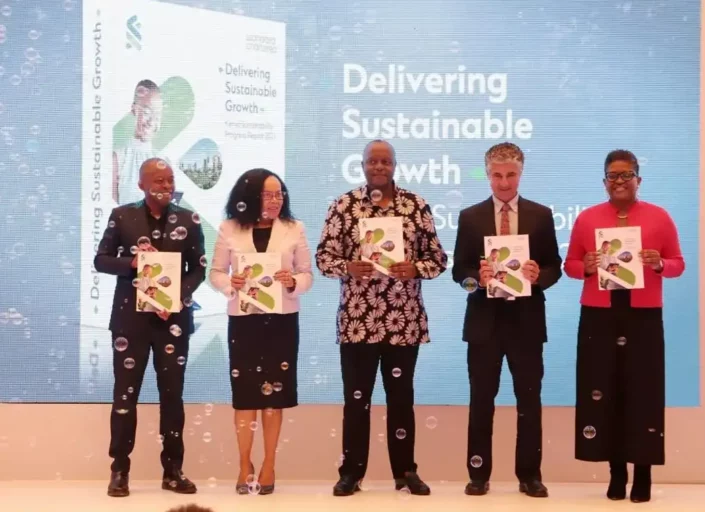

Highlights from the 2023 Report

- Sustainable Finance Assets: The bank’s total sustainable finance assets reached KES 3 billion in 2023, a 13% increase from the previous year.

- Gender Diversity: The bank has made significant progress in achieving gender parity, with female representation on the board increasing from 23% in 2019 to 55% in 2023. Additionally, women hold 56% of executive management positions and 53.6% of all staff positions.

- Operational Sustainability: It has implemented measures to reduce its environmental footprint, including a 39% reduction in energy use through solar panel installations and a 42% decrease in paper consumption. They also recycle over 97% of their waste.

“To date, we have reduced our carbon emissions by 65 per cent since 2018 driven by significant investments in solar energy and improved waste management,” the lender said.

- Community Initiatives: Standard Chartered Kenya programs like Futuremakers, which reached over 21,000 participants in 2023, with a focus on empowering women (86%) and people with disabilities (14%).

‘We continue to promote economic inclusion and tackle inequality by empowering young people and supporting entrepreneurship. Our Women in Tech program and Access to Finance initiative have provided vital support to female entrepreneurs, driving positive change and creating opportunities for sustainable development,” said Kariuki Ngari, MD and Chief Executive Officer, Kenya and Africa for Standard Chartered.

Khusoko is now on Telegram. Click here to join our channel and stay updated with the latest East African business news and updates. Stay connected on your favourite social media channels: Twitter |Facebook |LinkedIn | Instagram| YouTube