I first encountered Real Estate Investments (REITs) during my postgraduate studies. I was unaware one had been rolled out and trading on the securities exchange.

Can you earn rental income in Kenya without owning any real estate property?

It has become increasingly more work to own real estate in Kenya due to the rising cost of land in urban and peri-urban areas, high statutory and professional fees, increased material costs and a crowded value chain, among other factors.

The next best option to be a participant in the real estate sector is through REITs.

Real Estate Investment Trusts offers a simplified solution to big-ticket investment in the real estate sector.

Real Estate Investment Trusts own or finance income-generating real estate across various property sectors. It pools resources from different investors and invests in real estate assets: commercial real estates like offices, warehouses and shopping malls that generate rental income.

Investors share in the earnings in the form of dividends distributed annually.

A REIT is similar to a good pizza; a company needs to knead and treat our dough (funds) well and distribute the pizza when ready depending on ticket sizes.

The US has the biggest public REITs market. According to Statista, the REITs market in the United States declined in 2022, reaching a market cap of 1.3 trillion US dollars, a decrease from the 1.74 trillion US dollars recorded in 2021 when the market peaked.

REITs in Kenya

REITs are relatively new products in our African continent compared to the equities, commodities and bonds markets operating for decades.

Kenya has only three authorized REITS: The ILAM Fahari I-REIT, Acorn student accommodation development REIT( D- REIT) and Acorn student Accommodation income REIT( ASA I- REIT).

The Real Estate Investment Trusts (REITs) launched in Kenya in 2015 to develop the country’s property market.

I will only focus on the listed REIT with readily available market information. ILAM Fahari I-REIT trades on the Nairobi securities exchange under the FAHR ticker and provides instant liquidity to investors who want to exit or get into the market, unlike real estate, which is generally illiquid and exiting may take a long time.

The unit price of the REIT depends on the fundamentals of the assets; its performance (occupancy rate), liquidity, and prospects ( ability to onboard new assets successfully in the future).

The upside of investing in REITs is it provides diversification to many small investors with small ticket sizes who cannot churn out high sums of capital required to invest in real estate.

Investors get to bypass the inconveniences of tenants and constant building upgrades. REITs are professionally managed with a trustee in place to safeguard the funds of investors and the assets are secured by long-term leases posing no risk to the unit holder.

They are exempt from income tax. However, investors are subject to a 15% withholding tax on income.

The drawback of a new product is that it has many grey areas. Understanding and penetration have been relatively low and could be why the share price has depressed since listing.

Any slowdown in the sector will negatively impact earnings which underpins the performance of the REIT. The I-REIT units trade like ordinary shares of a listed company and are not insulated from market volatility.

Investing in REITs gives investors some income guarantees through earnings distribution and capital gains resulting from the unit price movement.

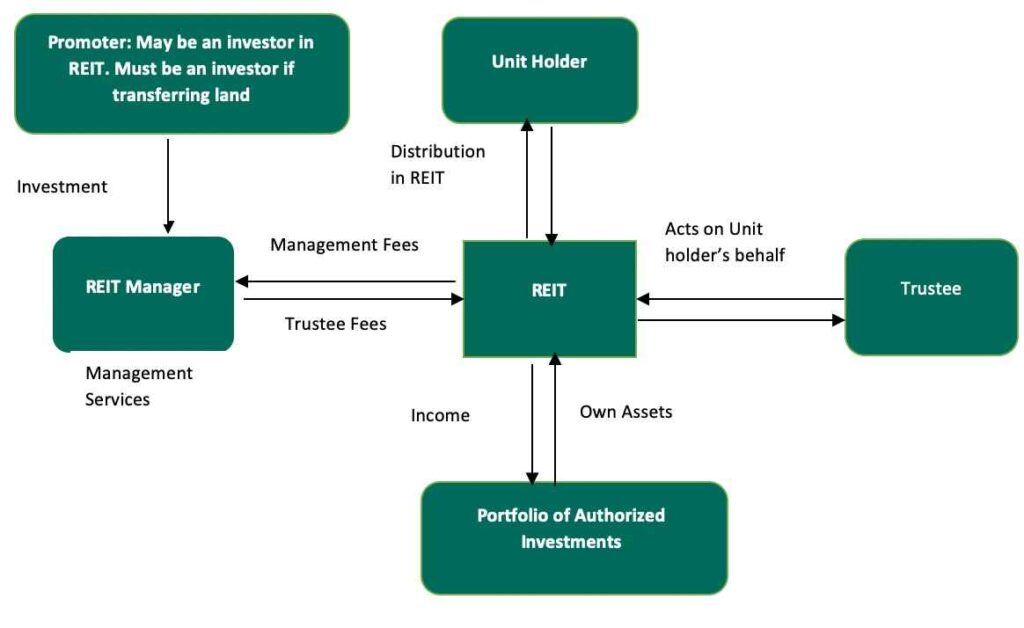

There are four essential parties who all work together to ensure that REITs’ interests are fully protected. These parties include:

- The Promoter: This is an individual or parties involved in setting up a real estate investment trust scheme. The Promoter is regarded as the initial issuer of REIT securities and is involved in submitting to the regulatory authorities to seek approval of a draft trust deed, prospectus or an offering memorandum.

- The REIT Manager: This company has been incorporated in Kenya and has been issued a license by the authority (CMA) to provide real estate management and fund management services for a REIT scheme on behalf of investors.

- The Trustee: This is a corporation or a company that has been appointed under a trust deed and is licensed by the regulatory authorities to hold the real estate assets on behalf of investors. The Trustee’s primary role is to act on behalf of beneficiaries, usually the investors in the REIT, by assessing the feasibility of the investment proposal put forward by the REIT Manager and ensuring that the assets of the scheme are invested in accordance with the Trust Deed, and,

- Project/Property Manager: The role of the project manager is to oversee the planning and delivery of the construction projects in the REITs. On the other hand, the property manager manages the completed real estate development that the REIT has acquired.

The ILAM Fahari I- REIT’sREIT’s unit price has compounded during the last five years at – 12.54% CAGR. However, over the previous three years, between 2019 and 2021, the share price compounded at a – 18.48% CAGR.

This shows a massive erosion in value, and investors should conduct further analysis of the business and business environment before making a buy decision.

According to Cytonn Investments, the Kenyan property market witnessed significant growth over the past years; however, in 2020, the real estate sector started on a relatively high note, but later, the Covid-19 pandemic affected the performance of real estate sector, especially in terms of access to finance.

First published on People Pennies. Ms Kasiva Mutisya is a Finance and Investment Analyst. Follow on Twitter & LinkedIn