Kenyan businesses are staring at heavy losses because of the planned weekly protests dubbed Maandamano against the high cost of living that began Monday.

Raila Odinga, the opposition leader, called for nationwide protests against the high cost of living.

“Kenyans are going through hard economic times; prices of basic commodities have skyrocketed, yet those who stole our victory are unable to cushion them,” he was quoted in a televised interview on Sunday.

On Monday, he reiterated, “We shall use all available, peaceful, and constitutional means to vindicate our rights.”

“Every Monday, there will be a strike, there will be a demonstration. The war has begun; it will not end until Kenyans have obtained their rights.”

It is of utmost importance that we rein in the runaway high cost of living for the benefit of ordinary citizens of our nation. This issue motivates us and keeps us going.

Today is the day for truth and justice.#DateWithDestiny20thMarch

— Raila Odinga (@RailaOdinga) March 20, 2023

Businesses count losses

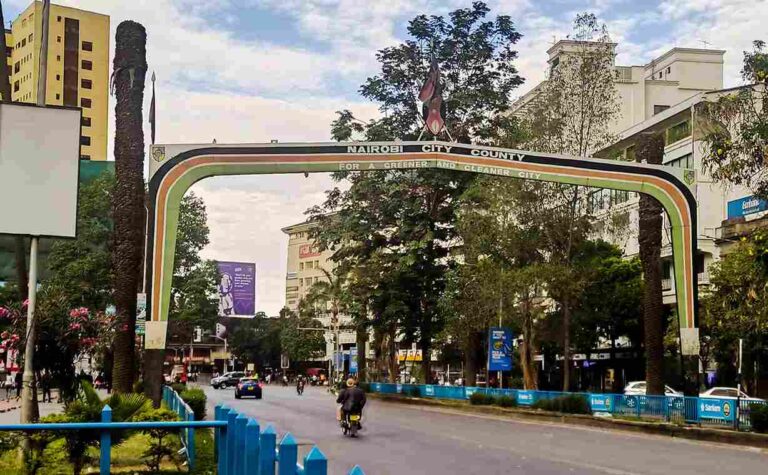

Most businesses within the Central Business District of Nairobi during the Monday protests remained closed.

“Quite a number of business people in Nairobi’s CBD did not open their shops and businesses arising from fear of looting and destruction of property having considered what happened in Kisumu where the Azimio people looted chairs and food,” said Deputy President Rigathi Gachagua while in Mombasa County.

“As a result, this morning (Monday), because of lack of business in the CBD the country has lost almost Ksh.2 billion in business and this is money that should have been circulating in the economy.”

According to the 2019 Kenya National Bureau of Statistics (KNBS) Gross County Product (GCP) report on how much the country’s 47 counties individually contributed to GDP, between 2013 and 2017, Nairobi’s share of the national GDP was estimated to be an average of 21.7%.

The Nairobi City County Fiscal Strategy Paper FY 2022-2023 outlines the county’s revenue and expenditure projections for 2022-2023 notes that by the end of the fiscal year 2020/21, the total actual revenues realised amounted to Ksh 29.62 billion against a target of approximately Ksh 37.17 billion.

The county generates revenue from rates, single business permit, parking fees, building permits, billboards and adverts and house rents.

In February, Kenya’s private sector activity contracted due to a depreciating currency, inflationary pressure on consumer spending and growing tax burdens for firms, according to the S&P Global Kenya Purchasing Managers’ Index (PMI), which fell for the first time since October to 46.6 in February from 52.0 a month earlier.

Follow us on Facebook, Twitter, LinkedIn, YouTube & Instagram to never miss an update from East Africa.