Equity Group has resumed shareholder payouts after a two-year-long hiatus due to the COVID-19 pandemic.

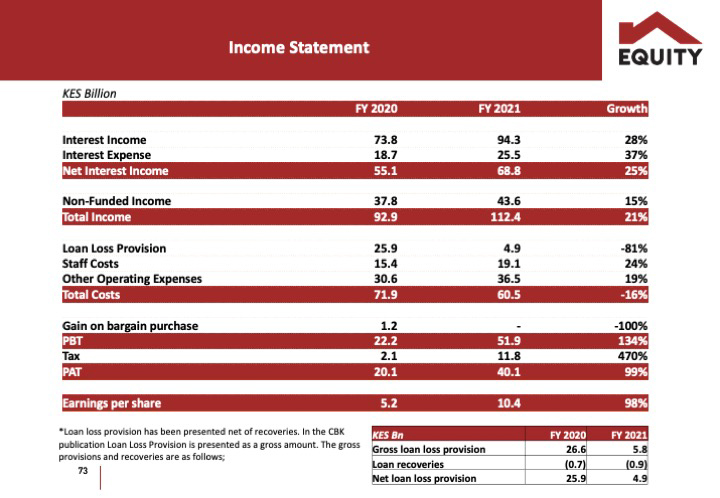

On Tuesday, the lender said its Board recommended a record dividend payout of Kshs 3 per share totaling Kshs 11.3 billion. This is a 50 percent jump from the previous dividend pay-out after earnings per share grew by 98 percent to Kshs 10.40 up from Kshs 5.20 the previous year.

However, this will be subject to shareholders’ approval and will be payable on or before 30 June 2022.

Equity’s last dividend payout was on the 2018 annual performance, with shareholders taking home Ksh7.54 billion.

During the year, the lender’s Profit After Tax increased by 99 percent to Ksh 40.1 billion from Kshs 20.1 billion with Profit Before Tax recording a growth of 134 percent to Kshs 51.9 billion up from Ksh 22.2 billion the previous year.

The Group has a positive outlook on the future through its Marshall Plan ‘Africa Recovery and Resilience Plan’ with a seed fund of USD 6 billion equivalent to Kshs 690 billion to act as a stimulus for the private sector.

The strategy aims at funding and financing 5 million businesses and 25 million households to reach 100 million people in Africa and to create 50 million jobs both directly and indirectly.

“We are optimistic that the ‘Africa Recovery and Resilience Plan’ holds great promise for Africa’s socio-economic prosperity and Equity Group is well-positioned to catalyze this outcome,” Dr. Mwangi says.

“As expected, Equity Group has delivered another impressive financial performance. Dividends per share (DPS) of Ksh 3.00 is likely to excite investors leading to a share price rally,” stockbroker AIB-AXYS said in a Tweet.

Benjamin Cheruiyot, from Abojani, noted that “Looking at the Ksh 50 share price, that’s a 6 percent dividend yield. It may be low at the current price, but those who took a position at the height of the Covid-19 pandemic and held all through have a near 10 percent dividend yield.”

Khusoko is now on Telegram. Click here to join our channel and stay updated with the latest East African business news and updates.