Sycamore Capital is the latest to be admitted to Kenya’s Capital Markets Authority (CMA) Regulatory Sandbox for six months effective 10 January 2022.

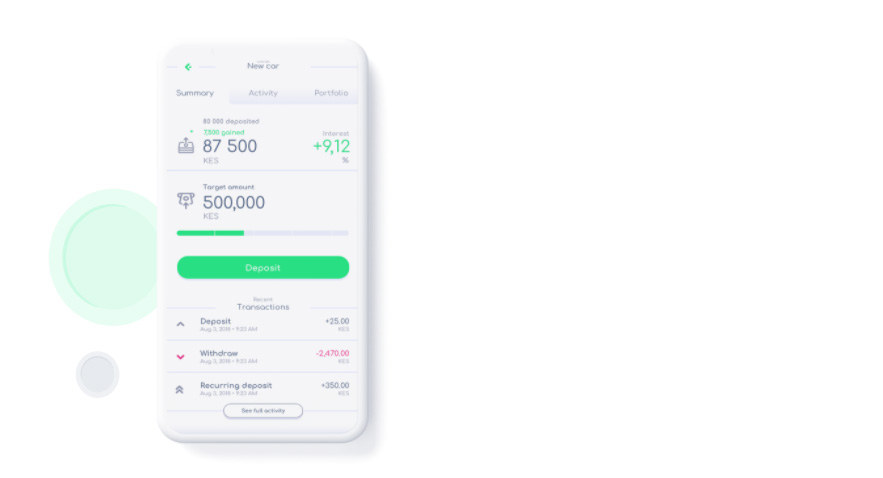

The fintech firm seeks to test its application named Cashlet App, a digital mobile-based unit trusts investment application.

‘The Cashlet App if successfully tested and rolled out in the open market, will play an important role in driving investor participation in the capital markets through collective investment schemes (CIS). It could contribute, in a way, to the growth of assets under CIS management over the current value of Kshs100 billion,” CMA Chief Executive Mr Wyckliffe Shamiah noted.

The platform has investment products managed by Madison Investment Managers, Genghis Capital, and Alpha Africa Asset Managers; who are also authorized and regulated by the CMA.

CMA sandbox rules mean that Sycamore Capital will be required to provide periodic reports on the implementation of its test plans, achievement of test objectives, risks and challenges observed during the testing period and a final report before the expiry of its testing period.

The admission of Sycamore Capital to the CMA Regulatory Sandbox raises the number of participants in the live test environment to 13.