It is said that investors don’t have a crystal ball, but the yield curve is the next best thing. More on this a little later. 2021 was an exciting year at the Nairobi Securities Exchange.

We witnessed the resurgence of corporate debt issuances (including Urban Housing Renewal Ltd’s interestingly tenured 18-month instrument priced at 11.0%); after a seemingly long wait, the debut share buyback was undertaken by the Nation Media Group (Jubilee Holdings and Centum Investment have since signalled intention to take the cue and rescue their market valuations through equity repurchase programmes) and, last but not least, day trading went live in Q4.

From a benchmark indices standpoint, YTD performance has been broadly favourable with the NSE All-Share and the NSE 25 up 12.1% and 10.1%, respectively, as at Dec 28th, 2021. The NSE 20 registered a more muted uplift of just 1.8% (YTD).

As we look into 2022, the concern is rife that with a general election on the horizon and COVID-19’s unrelenting torpedo of new variants looming large as a wild card in the risk profile, the markets could be roiled yet again as they were in 2020. I have a thought to share but first, let’s look at the rearview.

When listed telecommunications firm, Safaricom, made public its successful bid for the Ethiopia license (under the umbrella of the Global Partnership for Ethiopia) in May 2021, I expressed the counter-current view that there was a need to moderate expectations. Political risk, which has since been amplified by the situation in Ethiopia, was really at the back burner.

I had other concerns regarding the operating environment as well as what appears to be tapering earnings strength by the firm. The market, however, thought otherwise and the counter rallied touching a high of Kes 44.25 in August (from Kes 39.50 on the day prior to the announcement). The counter has since ceded ground closing Dec 28th at Kes 39.35.

Suppose, amidst the post-Ethiopia announcement rally, an investor decided to take a derivatives contract with a December 2021 maturity on Safaricom.

Safaricom is among the six single stock futures offered on the derivatives market. The others are KCB, Equity, Absa, EABL and BAT Kenya). By the time the contract was clocking the Kes 37.76 settlement price mid-December 2021 (down from about Kes 42.0 – 44.0 mid-year), the investor would have had an opportunity to offset losses in their Safaricom share portfolio by gains in the derivatives market. This would certainly be subject to trading fees.

It goes without saying that an investor would need to be wary of the daily mark to the market price of the contract since it comes with either credits or debits on their account on a daily basis (given that the contract is valued daily).

Just like the Safaricom counter in the spot market, the futures contract has not been on a downturn every single day and therefore upticks on some days would imply the short position loses and would require funding (i.e. debit from the investor’s trading account).

By and large, however, the 6 months trend has been bearish and therefore a short contract would have been the ideal play here. Futures contracts provide excellent hedging benefits to any spot market portfolio thus significantly mitigating any downward price risk

This takes me back to where this piece began.

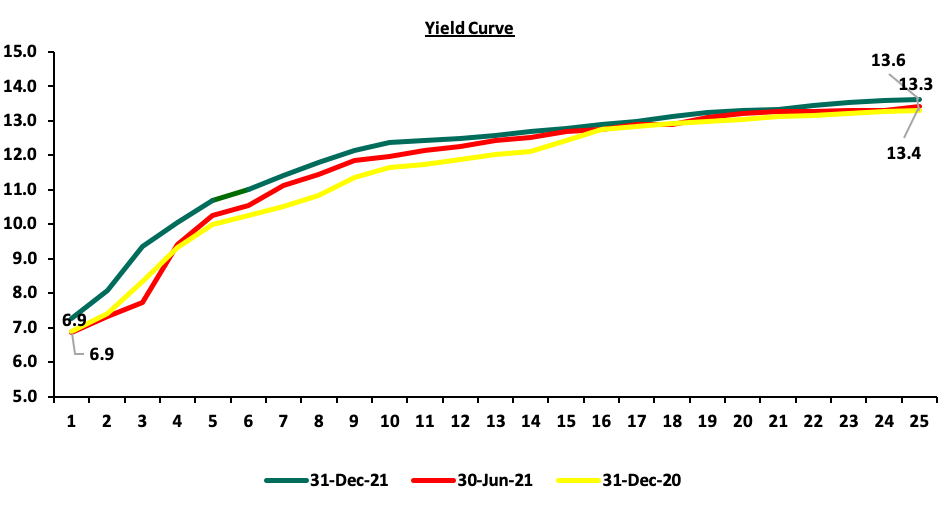

The sovereign yield curve was on a general uptick in 2021. Understandably, the subscription of government paper indicates that investors, awash with liquidity, have only been too happy to shovel money at issuances by the government. The government went out looking for about Kes 728 billion through bonds in 2021, investors tossed Kes 1.1 trillion at it. It is worth noting that corporate paper has also registered significant appetite from investors – the Kes 11.0 billion bonds issued by EABL was oversubscribed three times and Family Bank raised Kes 4.42 billion in June, registering 147.3% subscription.

With the economy headed for a year where the twin risks of the pandemic and the election looming large, it is likely that this appetite for the fixed income will rise and some players in the equities market may opt to take some chips off the table in favour of the safe harbour of government paper.

It doesn’t help that for the first time in about 18 months, headline inflation has sent the signal that it could be trending towards breaching the comfort ceiling. Indeed, the International Monetary Fund has already fired a warning shot based on the asset re-allocation being witnessed within the banking sector.

Further, whereas equities now account for 16.9% of assets under management held by pension funds (up from 14.2% in June 2020), this proportion is still below the 17.5% reported in December 2019 (pre-pandemic).

Banks’ holdings of government securities stand at a relatively high 31 percent of assets and are expected to rise further in the coming year (2022). Staff analysis suggests that while banks are adequately positioned to meet government’s financing needs, a substantial increase in such needs above anticipated levels could start to crowd out private credit growth. – IMF December 2021 Article IV Report

Since its launch a little over two years ago, the derivatives market has been off to a rather slow start. I believe part of it is a function of visibility and awareness challenges precipitated by the exchange itself and other capital market anchor stakeholders; part of it is really about market readiness for the product, often deemed to be complex and esoteric.

Like most, if not all, investors I am hopeful that the equities will avail opportunities for scoring compelling gains in 2022. Whilst clinging onto that hope, I am cognisant that the derivatives side offers some downside layer of protection.

Happy investing in 2022!

This commentary by Julians Amboko, Broadcast journalist and a Consultant Writer at The World Bank, originally appeared on linkedin on 3 January 2022.

1 Comment

Pingback: Kenya Mortgage Refinance Company to Float Kshs 10.5 Bn Bond