MTN Uganda on Monday listed 22.4 billion ordinary shares on the Uganda Securities Exchange (USE) following the successful completion of the initial public offering (IPO). It becomes the 10th local listed company on the Stock Exchange.

The listing reduces the ownership of MTN Group in MTN Uganda from 96 per cent to 83.05 per cent.

This aligns with the Ugandan Communications Commission’s new licensing requirement for broad-based ownership by Ugandans, with a compliance deadline of mid-2022.

“With this listing, MTN Uganda becomes the Ugandan stock with the largest market capitalisation on the USE,” said MTN Group President and CEO Ralph Mupita.

"It is a monumental time for the Exchange. Our market cap has gone up from 4.1 Trillion Shillings to 8.2 Trillion shillings during this period."

Ag. Chairperson of the Board @USEUganda Mr. Richard Byarugaba.#MTNlist #USENewList #InspiringGrowth #GrowWithUs pic.twitter.com/nE5KvqpFTo— Uganda Securities Exchange (@USEUganda) December 6, 2021

The initial public offer of MTN Uganda had a 64.8 per cent subscription raising UGX 536 billion (KSh16.94 billion) from 21,394 investors. The shares include sale shares and incentive shares.

The IPO, which was opened to East African investors –from Uganda, Kenya, Tanzania, Rwanda and Burundi— raised KSh16.94 billion (Ush535.9 billion).

MTN Uganda had sought to raise KSh27.6 billion from the sale of 4.47 billion shares, accounting for a 20 per cent stake of the company, at a price of UGX 200.00 (Ksh 6.28) per share.

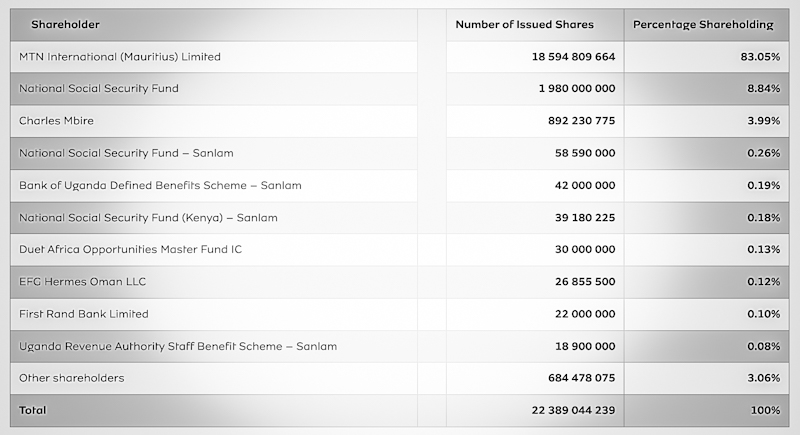

MTN Uganda Shareholding Structure

MTN International (Mauritius) 18.594 billion shares (83.05%), National Social Security Fund (NSSF) Uganda 1.98 billion shares (8.84%), Charles Mbire 892.23 million shares (3.99%), NSSF – Sanlam (0.26%), Bank of Uganda defined benefits Scheme – Sanlam (0.19%), National Social Security Fund (Kenya) – Sanlam (0.18%), Duet Africa Opportunities Master Fund IC (0.13%), EFG Hermes Oman (0.12%), First Rand Bank (0.10%), and the Uganda Revenue Authority staff benefits scheme – Sanlam (0.08%). Other shareholders have 684.47 million shares (3.06%), for a total of 22.389 billion shares.