The Kenya National Treasury said it has disbursed over Ksh 1.44 billion loans to Micro, Small, and Medium Enterprises (MSMEs) under the Credit Guarantee Scheme since its launch in Dec 2020.

The Credit Guarantee Scheme is one of the government’s incentives to mobilise private sector capital towards development goals.

Mr Ronald Inyang’ala, National Treasusry Ag. Credit Guarantee Scheme Manager and who serves also as the Deputy Director of Financial and Sectoral Affairs, disclosed that the amounts were disbursed during the period Dec 2020 to October 31, 2021.

During the period, 21 per cent of recipients of the credit was MSMEs owned by women, youth and Persons with Disabilities.

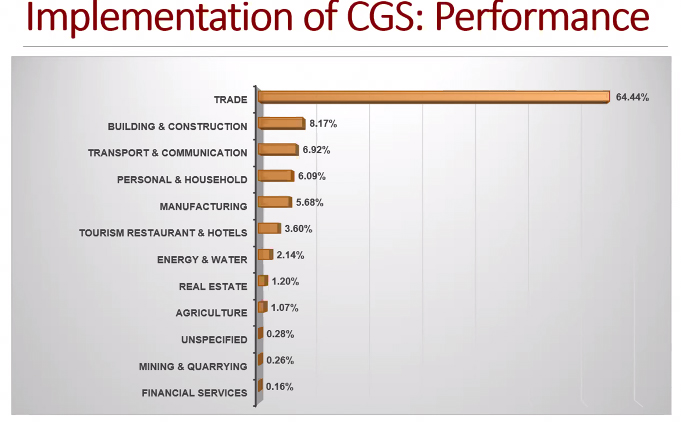

The MSMEs that have benefited are from 11 different sectors of the Kenyan economy. Trade took over 64.44 per cent of the credit followed by building and construction (8.17%) Transport and communication (6.92), personal and household 6.09%). Other sectors include manufacturing, tourism, restaurant and hotels, energy and water among others.

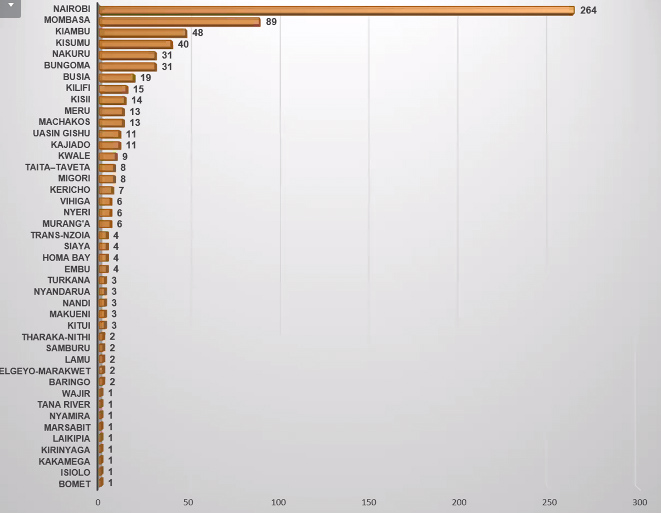

Businesses in Nairobi county had the highest uptake at 264, Mombasa (89), Kiambu (48), Kisumu (40) with the lowest in Wajir, Tana River, Nyamira, Marsabit, Laikipia, Kirinyaga, Kakamega, Isiolo and Bomet each at 1.

The design and structure of the scheme in terms of the coverage ratio, risk sharing, eligibility, loan limit and tenure of guaranteed amount have already been agreed upon. The coverage ratio, which is the proportion of exposure that is guaranteed by the scheme is 25 per cent. The risk-sharing ratio, which defines how the CGS and the PFIs will share the repayment in the event of default is at 50:50. The loan limit is Ksh 5,000,000, and the tenure of the guaranteed amount is 36 months

On the other hand, a grace period of up to 5 months is given if no payment or interest-only payments are determined by the borrower’s current cash flow.

The Government through the Public Finance Management Regulations (2020) set up a Ksh. 3 Billion stabilization facility to enable the participating banks (Absa, Co-Op, Credit Bank, DTB, KCB, NCBA and Stanbic) to extend credit to MSMEs that meet the requirements, including compliance with tax obligations and business permits and having a good credit standing.

According to the Central Bank of Kenya (CBK), Non-Performing Lonas (NPLs) in the banking industry increased by 0.09 per cent in the three months to September 30, while Return on Equity (ROE) declined to 21.97 per cent from 22.67 per cent in the same period.

The regulator’s quarterly credit survey of September 30, 2021, attributed the increased NPLs to a slowdown in business, company closures and job losses.

According to the quarterly survey, gross loans for the entire banking industry increased by 2.7 per cent in the three months to September 30, to $28.48 billion from $27.76 billion in June.

Can we Realize the Potential of Digital Revolution to Save MSMEs?