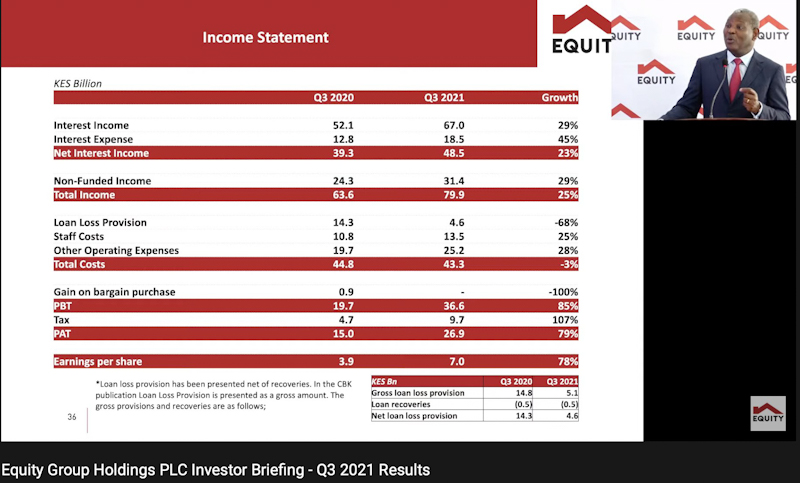

Equity Group Holdings Plc delivered a 79% surge in profit after tax to Ksh 26.9 billion in the third quarter of 2021.

The Group’s nine-month pretax profit rose 85% to Ksh 36.6 billion, helped by higher interest income, falling provisions for bad loans and growth from subsidiaries.

The Group’s earnings per share were up 78% from KSh 4.65 in Q2, 2021 to KSh 6.98 in Q3, 2021.

“We have now been tried and tested over the last two years during a very trying period. Our value is optimised when we put people first,” Equity Group Managing Director and CEO Dr James Mwangi said on Monday.

“Our results have been about being both on the offensive and defensive. We are warehousing our growth in the period ready to unleash it to the economy,” he added.

The offensive growth strategy has seen a 23% growth in net loans and advances and a 62% growth in investment in Government securities resulting in a 29% growth in interest income.

Here are the other highlights of the bank’s third-quarter financial report:

The growth in earning assets have been funded by a 48% growth in long-term funds of Kshs.104.8 billion up from Kshs.70.7 billion and a 27% growth in customer deposits of Kshs.875.7 billion up from Kshs.691 billion driving total assets growth of 27% to Kshs.1.184 trillion up from Kshs.933.9 billion.

Higher quality non funded income grew faster at 29% to Kshs.31.4 billion up from Kshs.24.3 billion than net interest income which recorded a 23% growth to Kshs.48.5 billion up from Kshs.39.3 billion. FX-trading income grew by 40% to Kshs.5.6 billion up from Kshs.4 billion.

“Non-funded income grew by 29% faster than the interest income from loan book which grew by 24.4 % as the bank deployed deposits to high-earning asset base other than government securities. We continue to look at where we can invest much for revenue,” Equity Group chief executive James Mwangi said.

“Total income grew by 25.5% compared to 16 % in the last period. We expect the opening of economy and removal of curfew will lift the interest higher.’’

“The bulk of this growth has come from our subsidiaries,” Mwangi said.

“We have seen some of our subsidiaries like Uganda growing its deposits by 47% and its asset base by 43 % and beaten by EquityBCDC in the Democratic Republic of Congo (DRC) which have grown their deposits 51 % and their assets by 47 % and for the first time we now see Kenya reduced to contributing only 58% of our total deposits and subsidiaries contributing 42 %.”

Best improvements were noted in the more mature subsidiaries of Kenya, Uganda and Rwanda.

Efficiency gains enhanced Group return on Equity to 24% up from 16.9% while return on assets improved to 3.2% up from 2.5%.

1 Comment

Pingback: Equity Bank Reduces PayPal Settlements to 24 Hours from 3 Days