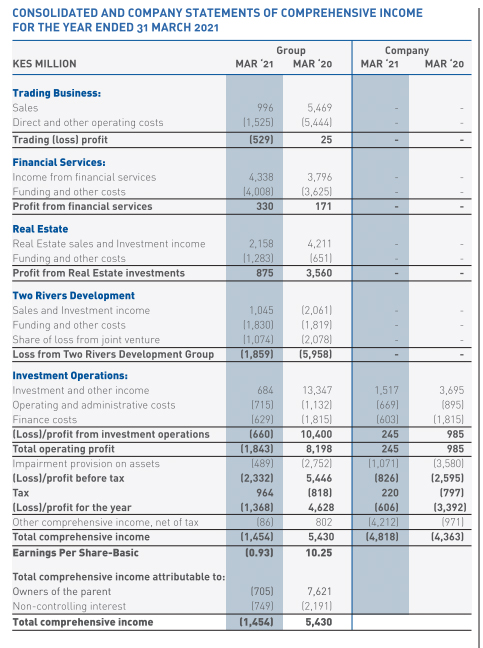

East Africa’s investment firm Centum posted a loss of Ksh 1.37 billion for the financial year ended March 31, 2021.

This is compared to KSh 4.63 billion net profit posted in the previous financial year.

The drop was attributed to its loss-making subsidiaries which posted a loss of KSh 1.9 billion.

In March, it issued a profit warning citing the coronavirus pandemic and lower disposal of investments to hit its profits.

As a result, the company said in its financial statement that:

“The boards of Two Rivers Development Limited (TRDL) and Two Rivers Lifestyle Centre (TRLC) have initiated steps to restructure the balance sheets in order to reduce the interest-paying debt and significant progress towards this objective has been made.”

On the flip side, shareholders will still receive a proposed dividend of KSh0.33 per share amounting to KSh218 million.

This is a 72.5 per cent low from KSh1.20 per share amounting to KSh798.66 million paid out in the previous financial year.

“The payment of the dividend is on the back of operating profit of KSh245 million the company recorded in the year and is intended to cushion our shareholders from the effects of the difficult economic conditions while allowing the company to retain liquidity, “said James Mworia, CEO at Centum.

The group’s total assets grew by 7 per cent to KSh109.4 billion from KSh 101.9 billion the previous year, supported by increased investments in marketable securities.

Total liabilities increased to KSh 61.5 billion from KSh 52.6 billion in the same period last year.

The group expects to return to profitability in this financial year.

“We have witnessed a strong recovery in performance across our portfolio companies and we hope that this recovery will not be interrupted by any unforeseen external economic shocks.”