Kenya’s fiscal deficit is likely to remain elevated at an estimated 9.00% of Gross domestic product (GDP) with an ambitious target to cut it to 7.5% in the 2021/22 financial year.

“Efforts to restore fiscal space will be complemented by the ongoing debt restructuring with a focus on spreading the sovereigns liquidity needs and reducing the overall cost of debt,” NCBA Market Research notes.

“Even then, fiscal discipline will be crucial for sustaining confidence in overall fiscal management,” they add.

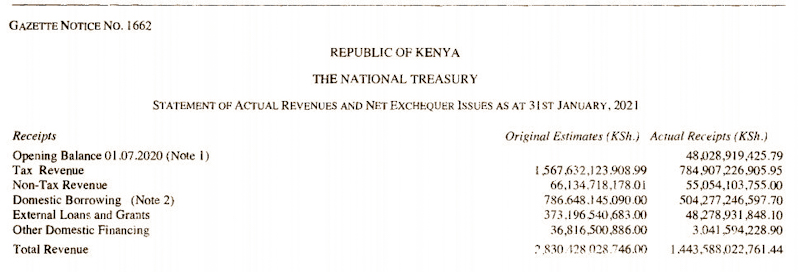

On the other hand, National Treasury’s statement of actual revenues and net exchequer issues as at 31st January 2021, total tax and non-tax revenues fell by 13% and 33% respectively (year on year) in the first seven months of the year.

Cumulative ordinary revenue hit Ksh 837.0 billion out of the Ksh 1.634 Trillion initial target. Over the same period, recurrent and development spending dropped by 5% and 17% respectively.

READ

NCBA Market Research is optimistic that revenues may improve in the second half of the year as the government withdraws earlier tax relief measures, increases the tax base and improves tax administration.

“The current run rate in tax revenue represents an underperformance of -14.2% at the end of the fiscal year although the National Treasury expects an uptick in revenue collection based on the tax reversals and new tax streams that took effect at the start of the year,” Genghis Capital corroborates.

“For the next fiscal year, we calculate an overall budget of Ksh 3.5 Trillion, of which budgetary allocation to the national government and equitable revenue share to counties to Ksh 1.97 Trillion and Ksh 370.0 billion, respectively,” Genghis Capital Research opines.

The National Treasury maintains that its debt remains sustainable at 65.6 per cent of GDP, but classified as high risk.

However, Treasury has proposed that the debt ceiling be increased to allow the government to borrow some more.

“The 2021 debt strategy is underpinned by the need to move away from relatively high interest cost of domestic debt, safeguard credit flow to the private sector and rely more on long term external financing, preferably concessional loans,” the Director-General, Public Debt Management Haron Sirma told the Senate Committee on Finance and Budget on Monday.

1 Comment

Pingback: Kenya Parliament Passes Supplementary Budget of Ksh KSh80bn