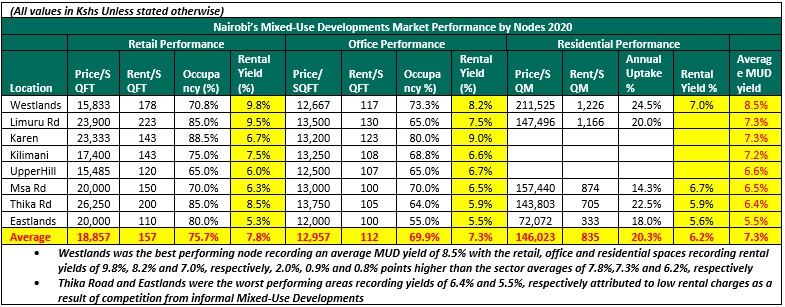

Westlands has been ranked as the best performing node recording an average Mixed-Use Developments with a rental yield of 8.5% with the retail, office and residential spaces recording rental yields of 9.8%, 8.2% and 7.0%, respectively, 2.0%, 0.9% and 0.8% points higher than the market averages of 7.8%, 7.3% and 6.2%, respectively.

This is according to Cytonn Real Estate Nairobi Metropolitan Area Mixed-Use Developments (MUDs) Report-2020.

The report analyses the performance of the MUDs within the Nairobi Metropolitan Area through tracking the changes in occupancies, rental yields and rental rates. It also outlines the outlook and investment opportunity for MUDs.

The performance Is attributed to the availability of prime office and retail spaces resulting in relatively high demand, and, the area being a prime commercial node with high demand for commercial and residential space supported by the relatively good infrastructure.

Limuru Road and Karen came in the second position with an average MUD rental yield of 7.3% each, largely driven by their attractiveness as retail destinations with malls such as Two Rivers and Galleria offering high-quality retail spaces in addition to hosting high-income earners with relatively high purchasing power especially in the case of Karen.

Eastlands was the worst-performing node recording an average rental yield of 5.5% attributed to low rental charges due to unavailability of quality space and relatively high competition from informal Mixed-Use Developments.

According to the report, in 2020 Mixed-Use Developments recorded an average rental yield of 7.1%, 0.3% points higher than the respective single use retail, commercial office and residential themes average of 6.8%.

The retail, offices and residential spaces in MUDs recorded rental yields of 7.8%, 7.3% and 6.2%, respectively, compared to the single-use average of 7.5%, 7.2%, and 5.6%, respectively. The relatively better performance by MUDs is attributed to the prime locations, mostly serving the high and growing middle class supported by the concept’s convenience as it incorporates working, shopping and living spaces.

However, on overall, MUDs recorded a 0.2% points y/y decline in average rental yield to 7.1% in 2020 from 7.3% in 2019, attributed to a tough economic environment caused by the Covid-19 pandemic that constrained consumer spending, led to reduced demand of space in MUDs amid reduced disposable income and reduced investor appetite as investors adopt a wait and see attitude in the wake of market uncertainty.