The Kenya Revenue Authority (KRA) tax collection for October was Ksh 108.7 billion, down 14.7 percent over the same period of the last fiscal year.

This from Ksh 125.98 billion at the same time last year as the effects of the COVID-19 pandemic continues to affect revenue collection.

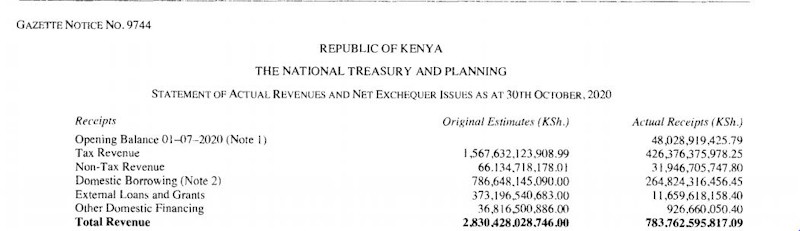

According to the National Treasury and Planning Statement f Actual Revenues and Ne Exchequer issues as at 30 October 2020, ordinary revenues to include non-tax income reached Ksh 115.7 billion after Ksh 7 billion in grossed non-tax income compared to Ksh 129.6 billion collected last October.

In terms of spending, recurrent and development expenditure amounted to Ksh 72.9 billion and Ksh 12.0 billion respectively month under review.

“The year-on-year underperformance reflects the impact of the Tax Laws (Amendment) Act 2020 which revised lower the tax revenue targets in the current fiscal year and coupled by the worsened environment wrought by Covid-19 pandemic,” Genghis Capital Commented in their weekly bulletin.

Cumulative debt service costs totaled Ksh 246.3 billion as at end of October.

“Overall, the debt service costs equal to 53.7% of the ordinary revenue – slightly below the overall FY2020/21 target of 55.4% – on a cumulative basis signifying a key pressure point on effective budget execution,” added Genghis.