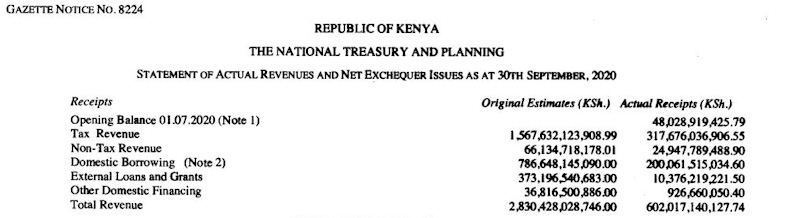

Tax collections for the first quarter of the 2020/21 fiscal year fell almost 15% to Ksh.317.7 billion against the previous year’s Ksh.151 billion.

This largely attributed to the COVID-19 pandemic which hit on various tax heads including excise duty and income taxes according to the National Treasury statement on actual revenues and net exchequer issues as of September 30, 2020.

From the data, Kenya Revenue Authority (KRA) in September collections declined 14.2 percent equivalent to Ksh.129.6 billion from Ksh.151 billion in September 2019.

Non-tax revenue collections doubled in the period to Ksh.24.9 billion from Ksh.12 billion last year.

Cumulatively, ordinary revenue at end of September stood at Ksh.342.6 billion down from last year’s Ksh.384.3 billion.

National Treasury’s draft Budget Review Outlook Paper (BROP) report revised its ordinary revenue target down by Ksh 110.3 billion and Ksh215.5 billion in FY2020/21 and FY2021/22, respectively.

“The downward revisions on the ordinary revenue projections have been priced on the back of Ksh 41.96 billion miss in FY2019/20 (base fiscal year),” said Genghis Capital adding that, “These revisions mainly reflect the knock-on consumption and international trade in the Covid-19 fallout period.”

READ