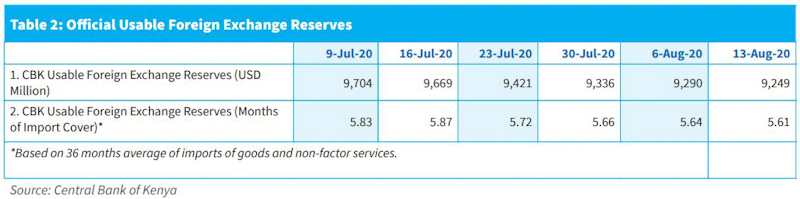

Kenya’s foreign exchange reserves dropped $9,249 billion in the week ended August 14, down by $41 billion from the previous week, according to theCentral Bank data.

The CBK indicated that its usable foreign exchange reserves remained adequate at USD 9,249 million (5.6 months of import cover) as at August 13.

“This meets the CBK’s statutory requirement to endeavor to maintain at least 4 months of import cover, and the EAC region’s convergence criteria of 4.5 months of import cover.”

The forex reserves have continued to decline since July 9 when the when Kenya started phased reopening of the economy.

In the week, the Kenyan Shilling depreciated by 0.3 percent against the US Dollar to close the week at Kshs 108.3, from Kshs 108.0, recorded the previous week.

Market analysts attribute the depreciation on demand for the US currency from Safaricom ahead of KSh56.09 billion dividends payout. On a YTD basis, the shilling has depreciated by 6.9 percent against the dollar, in comparison to the 0.5percent appreciation in 2019.

“It exchanged at KSh 108.39 per US dollar on August 13, compared to KSh 107.95 per US dollar on August 6,” said CBK.

Safaricom announced a final dividend of KSh1.40 per share amounting to KSh56.09 billion, an increase from KSh1.25 (KSh50.1 billion paid in the previous year). The payout will be made on or before end of August.

****

“To be sure, endogenic market dynamics will tend to suggest an improvement on the local unit; ‘normalizing liquidity’ that has waded off injection activities.

To an extent, the recovery in diaspora remittances from the April dip is also another supportive exogenous factor.

So the engulfing question is, why the recent weakening of the shilling?

We still hold the view of an outsized corporate demand for hard currencies which has exacerbated pressure on the domestic unit.

Currency weakness tends to be a solid absorbing mechanism to the extent exports pick up the slack,” Genghis Capital Cross-Asset Weekly Strategy dated August 17.