TransCentury PLC on Thursday said it has kickstarted the process to seek shareholder’s nod for delisting the company.

This inline with ongoing strategic initiatives by the company as outlined in its Ahidi 2018-2022 strategy plan.

The overarching objective of the strategy is to deliver consistent, sustainable, attractive returns to the shareholders, through transformative and innovative investments, and in return attract the right investment opportunity, capital, partners and talent.

The Group Chief Executive Officer Mr. Nganga Njiinu said: “While we have seen liquidity reduce in the capital markets across the region, we have also seen an increase in funding that is available for private/ non-listed businesses, especially In the sectors that we focus on and have received interest from potential financiers who would provide capital that is structured in line with our strategic plan.”

“We, therefore, want to position the business to access these additional sources of growth capital to be able to capitalize on the great opportunities we have created in the last 3 years.”

Virginia Ndunge, Company Secretary in a notice seeking shareholder approval for delisting said “…TC has commenced a process that may result in material changes in the company’s listing status.”

The completion of the process is subject to regulatory and shareholder approvals.

The Infrastructure Company listed on the Nairobi Securities Exchange has scheduled to hold an Extraordinary General Meeting 30 July 2020 to deliberate on the matter.

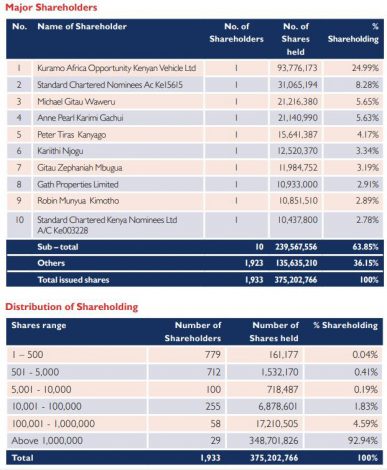

According to the frim, all the issued ordinary shares of the company comprising 375,202,766 shares of par value Ksh 0.50 each shall be delisted from the official list of the Alternative Investment Market Segment of the NSE.

By the end of 2018 Financial year, only two directors out of six held shares: Kariithi Njogu (12,520,370) and Wanjuki Muchemi (3,912,670).

Shareholders will get to cast their votes on 30 July during the virtual EGM.

The delisting process requires a majority of its public shareholders to vote in favour of the special resolution, or at least twice the number of votes cast against it. The results of the resolutions will be published on the company’s website within 24 hours following the conclusion of the EGM.

In June, it had reached a debt settlement and restructuring agreement with SBM Bank (Kenya) Limited leading to the withdrawal of its petition to liquidate it.

TransCentury has been struggling with a debt burden, losses, and a plunge in its share price but recently completed a debt restructuring deal with East African cables that has reduced the group’s debt by KShs 1.6 billion.

The remaining debt amounting to KShs 1.6 billion was taken over by a new lender and restructured to a tenor of ten (10) years with a moratorium of six (6) months and twenty-four (24) months on interest and principal respectively.

The Group also, through its subsidiary Civicon Limited renegotiated its maturing obligations with Equity Bank Kenya Limited to a new banking facility for a tenor of seven (7) years with twelve (12) months moratorium on principal repayments. The Group in its 2018 Annual report said it made part settlement of KShs 253 million to the bondholders.

TransCentury PLC operates three divisions across 14 countries in East, Central, and Southern Africa. TCL operating divisions include; Power Infrastructure, Infrastructure Projects, and Engineering.

RELATED