This content has been archived. It may no longer be relevant

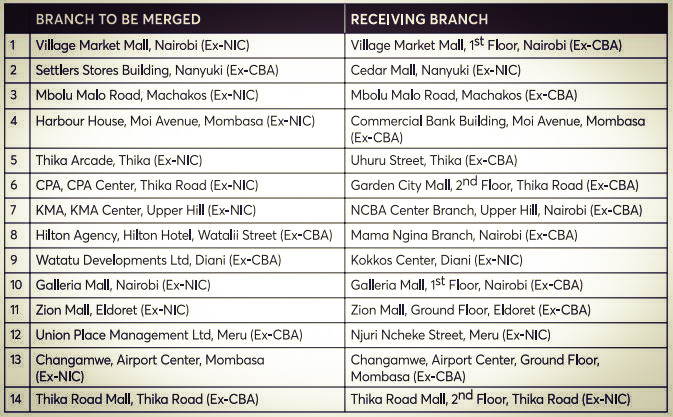

NCBA Bank will merge and permanently close 14 of its branches following approval from the Central Bank to achieve operational efficiencies and enhance service delivery.

Some of the affected branches had been temporarily closed since April 1, 2020, attributed to the effects of the Covid-19 pandemic.

The lender had said the branches were either co-located with or in close proximity to an alternative branch. As a result, its staff have been integrated into other branches.

READ

“The proposed actions will enable NCBA to accelerate the realisation of merger synergies, create operational efficiency and enhance service delivery,” said John Gachora, Managing Director NCBA Group Plc.

“The branches will be merged with the impacted branches ceasing operations with effect from close of business on July 4, 2020.”

The latest move is contrary to the bank’s projections to open 15 branches this year.

However, Gachora says the plan is still being evaluated.

“We are optimistic that the economy will begin to see some recovery towards the last quarter of the year. We might not open all the planned branches but NCBA has an ambition to increase its footprint across the country as part of its growth strategy.”

Some of the affected branches are Nairobi (6), Mombasa (3), Nanyuki (1), Meru (1), Machakos (1), Kiambu (1) and Eldoret (1).

According to Gachora, staff members from the affected branches will be redeployed appropriately to support other branches or business units within their network.

He noted the business had seen an increased use of alternative channels such as online and mobile banking since the start of the pandemic in Kenya.

READ