This content has been archived. It may no longer be relevant

Treasury bills were oversubscribed by 112.7per cent an increase from 56.9% recorded the previous week underscoring the ample liquidity in the market.

The money market was liquid during the week ending April 2, supported by government payments.

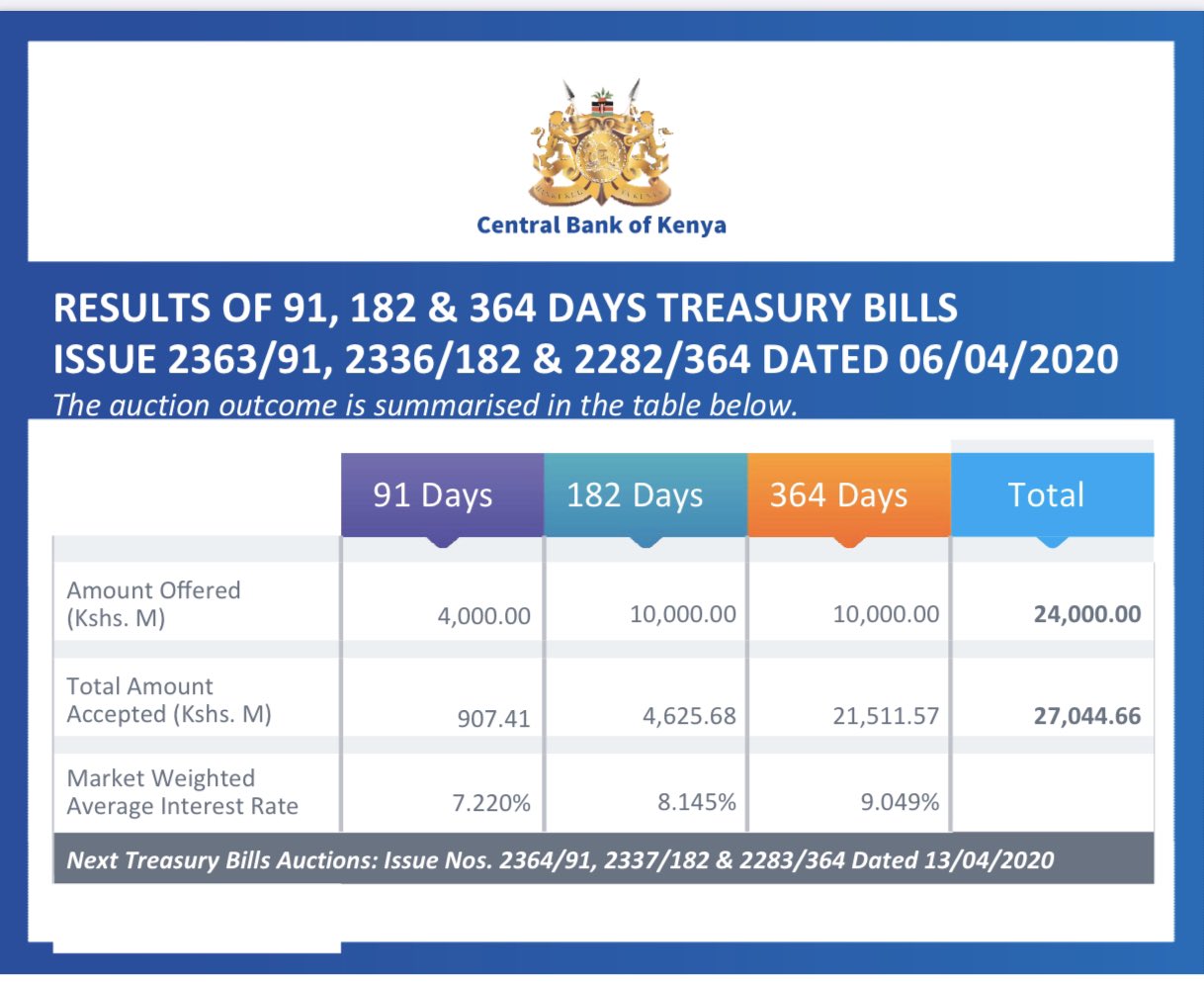

The Central Bank of Kenya (CBK) had offered KSh4 billion, KSh10 billion and KSh10 billion for the 91-day, 182-day and 364-days papers, respectively.

The 91-day paper received bids worth KSh 907.41 billion, 182-day paper attracted KSh 4625.68 billion while the 364-day paper received Ksh 21, 511. 57 billion.

The yields on the 91-day, 182-day papers, and 364-day paper remained unchanged at 7.2 per cent, 8.1 per cent, and 9.0 per cent respectively.

The acceptance rate increased to 100.0 per cent from 85.3 per cent recorded the previous week, with the government accepting all the Ksh 27.0 billion worth of bids received.

“Interest rates on the 182-day and 364-day Treasury bills increased marginally, while the rate on the 91-day Treasury bill decreased,” CBK said in its weekly bulletin.

Kenya Treasury Floats KSh 60 billion Nine Year Infrastructure Bond