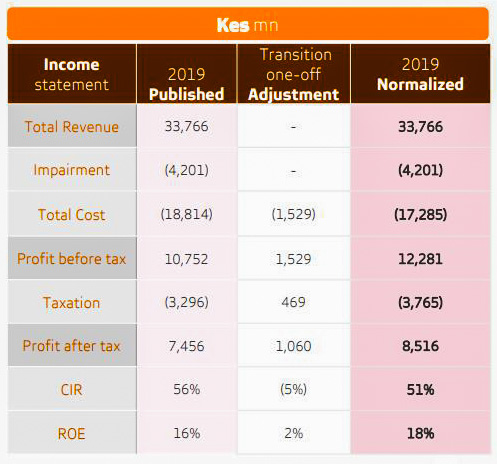

ABSA Kenya Plc announced a normalised profit after tax of Kshs8.5 billion for 31 December 2019, as rebranding costs ate into its bottom line.

However, the lender said it was pleased with the financial outcomes, ‘Which are a validation that our strategy is working.

It disclosed that it spend Ksh 1.5billion in the rebranding exercise into Absa.

“The performance is mainly attributable to a 7% growth in total income, 1% growth in operating costs partially offset by a 9% growth in impairment,” the Nairobi Securities Exchange-listed lender said on Tuesday.

Normalized earnings are adjusted to remove the effects of seasonality, revenue and expenses that are unusual or one-time influences.

Total assets grew by 15% year on year, driven by growth in customer loans, government securities, and other liquid assets.

Net customer loans were up 10% to close at Kshs195 billion, driven by key focus products: general lending, asset finance, mortgage and scheme loans that recorded strong growth year on year.

Customer deposits grew by 15% to Kshs.238 billion, with transactional accounts making up 70% of the total deposits.

During the period, total income increased by 7% to Kshs33.8 billion, driven mainly by the growth of non-interest income, which was up by 9% yearly.

The Bank said it will use the normalised profit in making its decision on dividend and therefore exclude the impact of the one-off separation costs.

The Directors have resolved to recommend to members at the forthcoming Annual TGeneral Meetin a final dividend for the year of Ksh 0.90 per ordinary share of the company.

In October 2019, an interim dividend of Ksh 0.20 per ordinary company share was paid out.

*****

“We expect robust customer deposit growth going forward, attributed to the bank’s aggressive strategy focused on the retail and SME banking segments under ABSA brand. The KES 0.90 final dividend payment (KES 1.10 total dividend) translates to a dividend yield of 10.8%, which should be very attractive for income investors, with the highest dividend yield in our coverage.

Further, the bank remains fundamentally sound, with the only operating metric raising concern being NIM (7.7% in FY19 compared to 8.5% in FY18). We recommend a BUY on ABSA with a target price of KES 14.78, representing a potential upside of 44.9%,” Genghis Capital’s ABSA Bank Kenya (NSE: ABSA) FY19 Earnings Note.

Barclays Kenya Name Change to Absa Bank Brings Possibilities to Life, CEO Says

1 Comment

Pingback: Absa Bank Kenya Posts 8% Pre-provision Profit of Ksh 17.9bn