This content has been archived. It may no longer be relevant

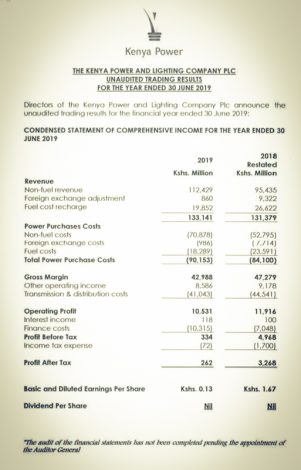

Kenya Power and Lighting posted a 17.8% increase in revenue, but with 92% reduced profit in its unaudited trading results for the year ended 30 June 2019.

Its lower net earnings of Ksh 334 million compared to Ksh 4,968 million in the previous year are being attributed to increase in non-fuel power purchase costs by Ksh 18,083 million from Ksh 52,795 million to Ksh 70,978 following the commissioning of Lake Turkana Wind Power Plant and the Garissa Solar Power Project with a combined generation capacity of 360Mw during the period.

The delay in their full-year results is as a result of there being no auditor general.

Imelda Bosire, the Company Secretary said revenue from electricity sales grew by Ksh 16,994 million from Ksh 95,435 million the previous year to Ksh 112,429 million. “The rise was attributed to a tariff review at the beginning of the year prior to the subsequent tariff harmonization that lower rates for Small Commercial Customers and broadened lifeline tariff for Domestic Customers.”

Under the Lifeline tariff, the Energy Regulatory Commission says over 3.6 million Kenya Power customers who consume less than 10 units per billing cycle, now pay between 36 and 82 percent less for electricity as the regulator also announced the removal of the KSh150 standing charge in 2018.

The review was made to accommodate more renewable energy costs and address the numerous complaints by electricity domestic customers on the complexity of the tariff billing regime.

It was also supported by a 3.4 percent increase in unit sales owing to an expanding customer base.

However, the company’s finance costs rose by 46.4 percent to Ksh 3,267 billion due to increased levels of short-term borrowing ‘to bridge cash flow shortfalls’ and foreign exchange losses.

As a result, its income after tax was Ksh 262 million compared to Ksh 3.268 million the previous year after taking into account a tax charge of Ksh 72 million.

“Fundamentals of the business have weakened significantly with the business grappling with cashflow challenges, rising debt levels (and interest costs) and excess power supply. As per the last audited (qualified) accounts, the Auditor General cited inadequate provisioning, negative working capital, default of debt covenants and significant amounts of undeclared financial assets with possibilities of large penalties. These could be the basis of restatements of prior accounts. We await to see the efforts of the recently appointed substantive management to steady the business,” Genghis Capital Analysts KPLC FY19 Earnings Note commentary.

KPLC is engaged in the transmission, distribution, and retail of electricity purchased in bulk from Kenya Electricity Generating Company Limited (KenGen), Independent Power Producers (IPPs), Uganda Electricity Transmission Company Limited (UETCL) and Tanzania Electric Supply Company Limited (TANESCO).

READ: