The uptake of Kenya’s short term Treasury bills slumped to a 28-month low in the week ending Dec. 27 with subscription rate coming in at 17.0%.

This was lower compared to 64.1% recorded in the previous week.

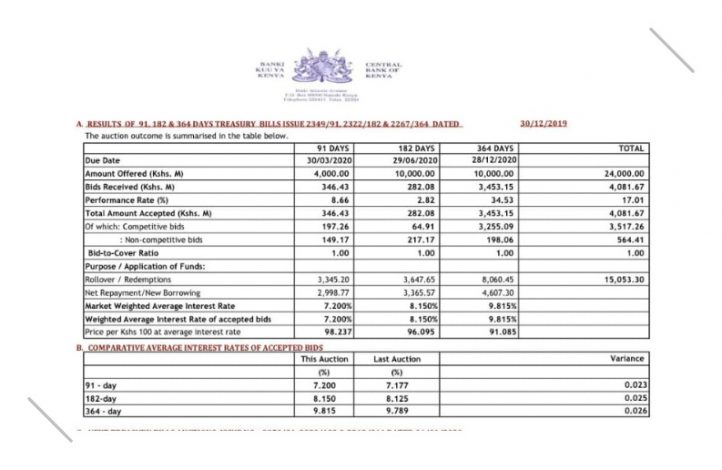

Central Bank’s data showed that in the auction it received bids totaling KSh 4.1 billion against an advertised amount of KSh 24.0 billion.

“The low performance was mainly on account of quarter four tax payments by banks and increased cash demand for the Christmas festivities,” said the Central Bank in its Weekly bulletin.

Not unusual for the last auction of the year to be heavily under-subscribed. Most banks and fund managers square their books earlier and give the last couple of year-end auctions a miss

— Sunil Sanger (@Sang252) December 24, 2019

“This is down from an average of 125.4% from January 2019 to November 7th, 2019 before the repeal of the rate cap; and 98.2% points lower than the YTD average of 115.2%,” Cytonn Investment commented.

The yield on the 91-day and 364-day paper remained unchanged at 7.2% and 9.8%, respectively while the yield on the 182-day paper increased to 8.2% from the 8.1% recorded the previous week.

“The need to sustain strong liquidity buffers has undermined demand for T-bills. Low demand may typify the auction for the next at least two issues,” according to NCBA Analysts. “However, price discovery seems to have been hazy given the low volumes . Therefore, inferring any direction on this backdrop may be misleading although risks are evidently tilted to the upside. “

“The need to sustain strong liquidity buffers has undermined demand for T-bills. Low demand may typify the auction for the next at least two issues,” according to NCBA Analysts. “However, price discovery seems to have been hazy given the low volumes . Therefore, inferring any direction on this backdrop may be misleading although risks are evidently tilted to the upside. “

Mohammed Wehliye, a financial adviser Saudi Arabian Monetary Authority was taken by the performance.

“17 percent performance rate? If this persists in January, we face a Debt default. Cash crisis in the horizon as everyone is focused on BBI (a show about nothing).”

“Ease liquidity constraint through monetary policy operations. Inject liquidity. Buy FX, lower CRR. The economy may be contracting,” he Tweeted.

Ease liquidity constraint through monetary policy operations. Inject liquidity. Buy FX, lower CRR. The economy may be contracting. https://t.co/3Q2Qg4K3Y9

— Mohamed Wehliye, MBS (@WehliyeMohamed) December 25, 2019