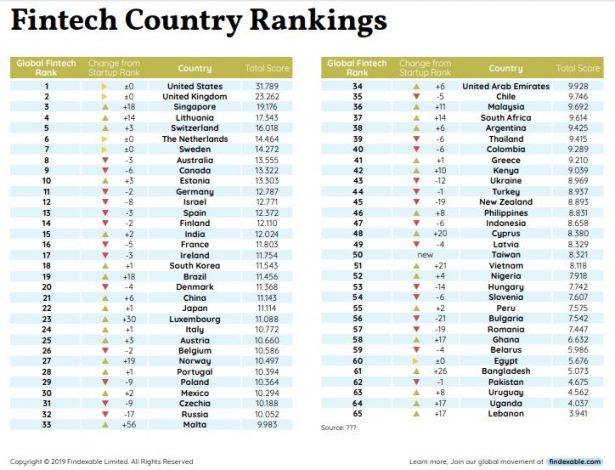

Kenya has been ranked 42 globally in the Global Fintech Ranking by Findexable an improvement of ten positions attributed to the introduction of fintech friendly regulations.

Some of the regulations are spearheaded by the Central Bank of Kenya which regulates the financial industry, the National Payments Systems Act, National Payment System Regulations 2014 and the Capital Markets Regulatory Sandbox Policy Guidance Note.

Capital Markets Authority Named Most Innovative Capital Markets Regulator in Africa

Data from the Global Fintech Index 2020, Cambridge Centre for Alternative Finance, Finnovating for Africa 2019 Medici and Milken Institute, Kenya ranks first out of 10 countries dubbed ‘Watchers’ in 2020 and beyond.

They include Kenya, the Philippines, Cyprus, Vietnam, Nigeria, Peru, Ghana, Bangladesh, Uganda and Lebanon.

“The countries here are fast-growing fintech destinations with much higher Fintech Index rankings than their Global Startup scores – and picked for their combination of local entrepreneurial success, regulatory foresight and the early signs of a growing local fintech ecosystem,” reads the report.

In the global ranking, South Africa is ahead in the continent.

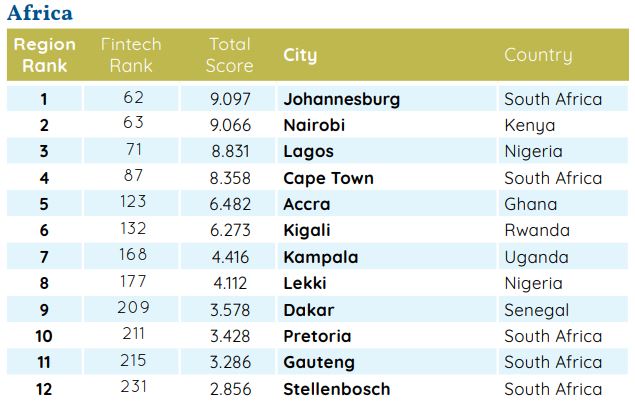

The ranking recognises Nairobi as a growing fintech hub. Findexable noted that the city is an emerging ecosystem, showing up to 20% of African fintech.

“Nairobi is Africa’s second-largest fintech hub, with an estimated 20% of African fintech. It is also an emerging ecosystem of local investors and VCs complemented by a steady rise of international investors and growing interest from global technology firms,” reads the Findexable Report.

Kenya is home to the Africa eXellerator Lab, SC Ventures Catalyst Fund, Mastercard Financial Inclusion Lab. Associations such as the Digital Lenders Association of Kenya and Blockchain Association of Kenya.