This content has been archived. It may no longer be relevant

Nairobi metropolitan real estate market is not ‘taking a deep dive at the moment’ in spite of the price stagnation on rental prices, house sales, and land prices attributed to lack of liquidity from constrained budgets.

Most of the investors and developers are grappling with lenders’ apathy and showing deeper signs of distress, reflected in the discounts offered by developers to push sales.

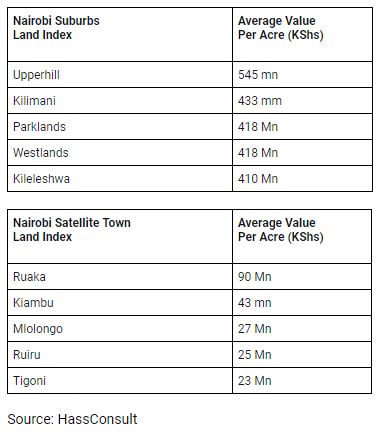

The HassConsult Real Estate Land Price Index for the third quarter of 2019 released on Tuesday is showing modest growth for both suburbs and satellite towns over the quarter.

“Land in Nairobi is growing at a very slow pace in terms of pricing. On average, it is at a stagnant rate,” said Ms. Sakina Hassanali, Head of Research and Marketing at HassConsult.

“Within the industry, we are seeing a lot of discounting on land and a lot of land is being offered by the banks. A lot of distressed sales however, the pricing is holding on asking prices on advertised prices,” she says.

Land prices in the suburbs increased by 0.22 percent over the quarter while in the satellite towns growth stood at 1.44 percent and 5.11percent annually attributed to their affordability than Nairobi.

Growth in the suburbs stood at 0.22 percent over the quarter and 1.69 percent over the year.

“These returns are higher than any other asset classes like government bonds and equities,” observed Sakina. “Investors are opting for assets that are able to withstand economic turbulence and this is what is influencing investment in land especially within the satellites.”

“The index, which compares Nairobi’s land price movements to other asset classes and commodities, found that the city’s land had outperformed all other asset classes in return on investment,” said HassConsult.

“We are very glad that the real estate is not taking a deep dive and it is holding on its own. It is stagnant. It is not growing. It is not exponential, there is discounting but it is definitely not taking a deep dive at the moment,” affirmed Sakina.

Going forward, HassCounsult says developers, buyers, and other investors are anticipating that the land market will get a boost should the interest rate cap be removed.

“The government agenda of late has been infrastructure driven which could have positive effect impact on property prices however the debt burden that has been created from this that is sweeping liquidity from the market and has the exact opposite negative effect,” she said.

“The real estate sector, similar to, other segments of the economy is challenged by the lack of liquidity as a result of the amendment of the Banking Act in 2016 that introduced interest rate caps.

“…but we expect this to change should interest rates become market-driven,” said Ms. Sakina adding that market-driven interest rates will also nudge banks to return to longer-dated loans as opposed to the present situation where most loans are short-term.

READ:

- What is Driving Kenya’s Real Estate Market?

- Kenya Real Estate Market Witnessed ‘subdued’ Performance in H1’2019 – Cytonn

Top 10 Most Expensive Places to Buy Land in Nairobi