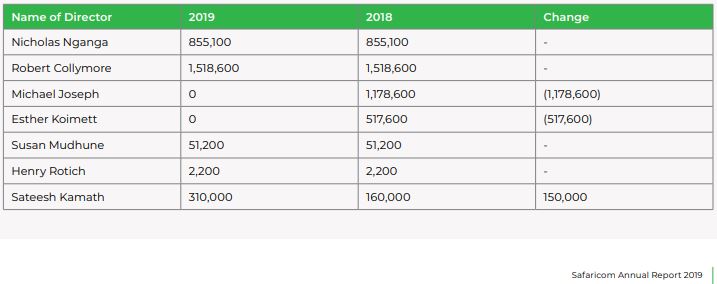

Safaricom’s interim Chief executive Michael Joseph and Esther Koimett, a Non-Executive Member of the Board, sold-off their shares in the company according to the Safaricom Annual Report 2019.

In the annual report, both sold all the shares held in the company in the course of the Telco’s financial year to March 2019.

Joseph sold 1,178,600 shares and Koimett 517,600 that were held in 2018. As a result, both will miss out on the total dividend of KSh1.87 per share announced at the 11th Annual General Meeting.

Koimett, who until recently was the Investment Secretary at the National Treasury, was the alternate director to the Treasury Cabinet Secretary.

During the period, it is only Sateesh Kamath, the Chief Financial Officer who bought 150,000 more shares to the current cumulative of 310,000 shares.

The rest of the members maintained what they had accumulated in 2018.

According to the company, Directors can purchase or sell shares of the Company in the open market. “None of the Directors as at the end of the financial year under review held shares in their individual capacity of more than 1% of the Company’s total equity.”

Safaricom will pay Ksh 50.08Bbn in the year 2019, plus a special dividend of Ksh 24.84bn at 0.62 cents per share making the total payout Ksh74.92bn.

Vodafone Kenya owns 40 percent shareholding and the Government of Kenya 35 percent will get Ksh 29.9 billion and Ksh 26 billion respectively.