The Board of National Bank of Kenya says KCB Group’s valuation of its shares falls below its independent valuation of KSh6.10 per share according to its ‘Shareholders’ Circular on the Proposed Take-over offer by KCB Group.

According to the report signed by Mohamed A. Hassan the Chairman, “The Offer made by KCB falls below the expected valuation range.”

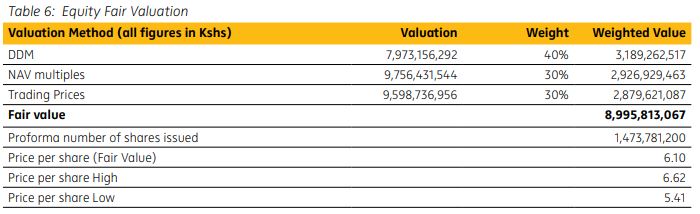

“Specifically, this report has placed the fair value of NBK share at Kshs 6.10 resulting in an equity valuation for a hundred percent shareholding in NBK of Kshs 9.0 billion (equivalent to a swap ratio of 6.23 shares of NBK for every 1 share of KCB).”

“NBK remains to be a strong bank, and it requires additional capitals to meet regulatory capital requirements and to grow its business, which can be provided by KCB,” NBK chairman Mohamed Hassan says in the letter to the shareholders.

NBK Board appointed Standard Investment Bank as an Independent Advisor, to provide the market value.

KCB Group offered to acquire a 100% stake in NBK on April 18, 2019, in a share swap transaction involving the exchange of 10 NBK shares for every one of KCB’s.

Take-Over Offer will be considered to be successful upon receipt of acceptances from shareholders with at least 75% of the Offer Shares.

KCB Group has 15 days to vary its offer.