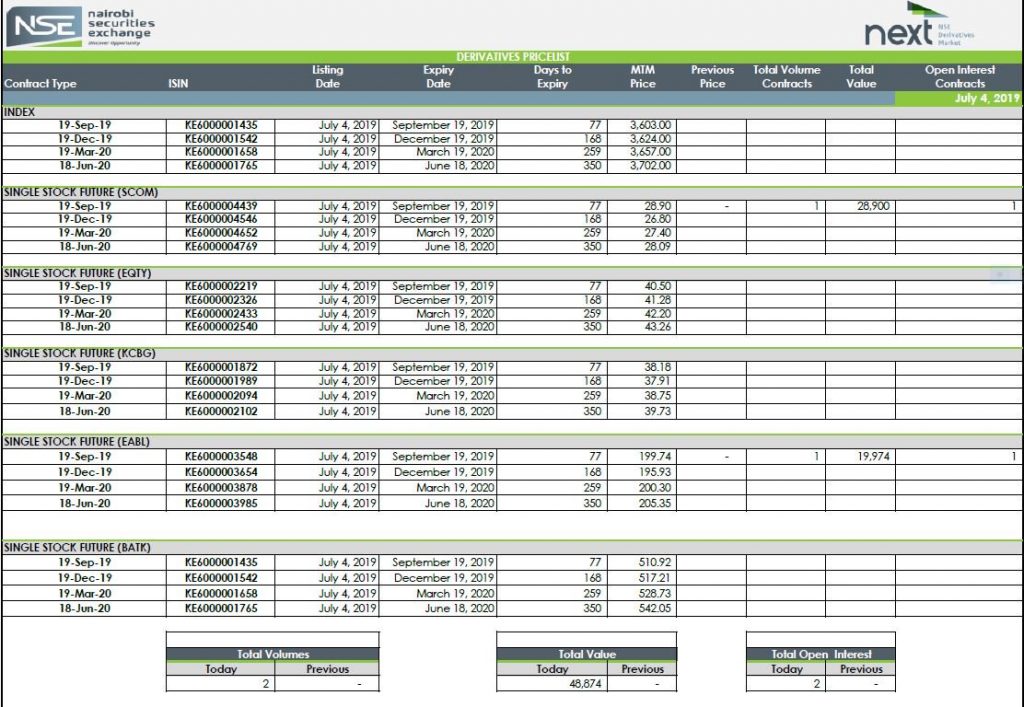

Two derivative contracts- East African Breweries and Safaricom- were traded at the Nairobi Securities Exchange (NSE) derivatives market on Thursday.

“We wish to notify market participants, investors and the public that the NSE NEXT derivatives market has successfully conducted its first futures trades. The initial trades were executed by Standard Investment Bank and Kingdom Securities who cleared through the Co-operative Bank of Kenya,” said the NSE in a statement.

The two contracts are worth KSh48,000 and will expire in September 2019.

The Safaricom PLC and EABL contracts delivery will be on 19th Sep 2019, strike price 28.90 Value of Ksh28,900 and strike price 199.74 value of Ksh19,974 respectively.

The NSE said their success laid a foundation for enhanced participation by both local and international investors.

“The NSE will continue to provide a world-class platform for the trading of futures contracts offering investors new opportunities to diversify their portfolios, manage their risks and deploy capital more efficiently.”

However, The Business Daily reported that Kenya Electricity Generating Company (KenGen ) and Bamburi Cement have been excluded from futures trading for failing the minimum capitalisation test.

The NSE trading rules for derivatives require participating single stocks to have a minimum average daily turnover of KSh7 million over the six months before review.

“All futures contracts listed on Next will have quarterly expiry dates; this will be the third Thursday of March, June, September and December of every year. All Next futures contracts will initially be cash settled,” NSE chief executive Geoffrey Odundo said in a statement Thursday.