Mobile banking and tech-savvy youth have become key enablers for supporting financial inclusion in Kenya according to the 2019 FinAccess Households Survey.

“Kenya has maintained its leadership on the financial services access front”, David Ferrand, FSD Kenya adding that “Our challenge is to harness these achievements and build a more inclusive financial system.”

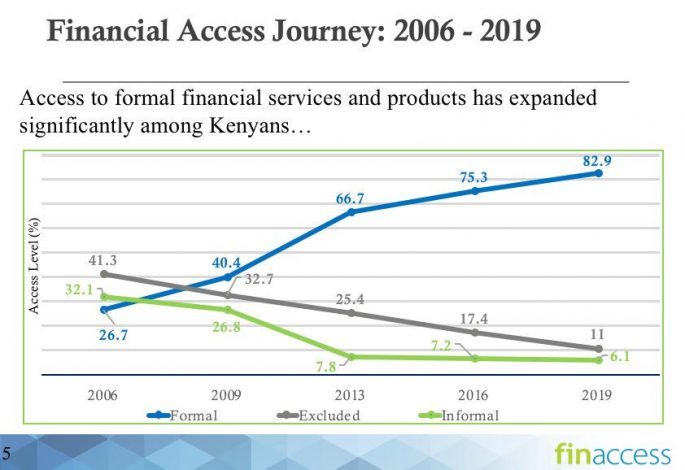

According to the report, access to financial services and products has expanded significantly among Kenyans ‘From 26% in 2016 to 82.9% in 2019’ only 11% of adult Kenyans are excluded from formal financial services. Down from 41% in 2006.

Further, the report found out that financial health among Kenyans worsened in 2019 attributed to gaps in access. “Implying reduced ability to use financial services and products to manage their daily needs, cope with shocks and achieve future goals.”

Dr. Patrick Njoroge, Governor Central Bank of Kenya during the launch acknowledged that “

The significant reduction in the proportion of the adult population totally excluded from financial services and products vindicates the policies, strategies and reforms undertaken by the government as well as widespread adoption of digital technology and innovations by financial sector players.”

“The way mobile money is growing is a big opportunity for us to continue in the inclusion agenda as we serve new needs of customers,” he added.

While digital transformation via mobile banking and digital apps has helped bring millions across Kenya into the economic fold, there is still a lot to be done. The survey concludes that it has led to raises in cybersecurity, credit risk, and consumer protection concerns.

For instance, the latest report by the Communication Authority (CA) shows for the three months to December, 10.2 million cyber threats were detected. “In particular, there was a rise in cases of malware and the sale of stolen data and credentials including personal data and credit card information,” the quarterly report stated.

During the period, the number of active mobile subscriptions grew 15.65% to 49.5 million subscriptions compared to 42.8 million subscriptions over the same period in 2017.

Thus, the “Promotion of financial literacy is important in addressing emerging consumer protection concerns,” states the 2019 FinAccess Household Survey published in collaboration with the Central Bank of Kenya in collaboration with Kenya National Bureau of Statistics (KNBS) and Financial Sector Deepening (FSD).

The 2019 FinAccess Household Survey report presents results of data collected during October – December 2018 covering 11,000 households across the country focusing on the usage, quality and impact/welfare dimensions of measuring financial inclusion.

Measurement of financial inclusion in Kenya commenced in 2006 through the creation of FinAccess surveys implemented over the years by the Central Bank Kenya (CBK), Kenya National Bureau of Statistics (KNBS) and Financial Sector Deepening (FSD) Kenya.

The FinAccess Survey constitutes an important tool for monitoring financial inclusion trends and dynamics, thus informing policy and industry on progress towards pro-poor and pro-growth financial sector development.