Kenya’s ultra high net worth individuals (UHNWIs) are moving their allocations into luxury homes, according to the latest Knight Frank Wealth Report, released on Wednesday.

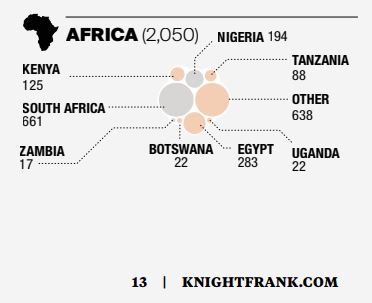

In Africa, Kenya leads the way, with 24% forecast growth by the end of 2023. This fits with more upbeat economic forecasts for Kenyan GDP in the coming years, yet risks remain to this economic outlook as the government looks to narrow its fiscal deficit. The number of ultra-wealthy people in the country is set to reach 155 in 2023, making up 6% of the total UHNWI population in Africa. – Knight Frank.

This signals bargain-hunting as prices for trophy houses soften amid an oversupply in the high-end market segment, tighter liquidity, and general market correction, making it a buyers’ market.

Despite the price drop last year, luxury property values in Nairobi have appreciated by 38% since 2010, according to Knight Frank Kenya research.

Ben Woodhams, Knight Frank Kenya Managing Director, said: “As a result of the oversupply, developers have had to deliver higher specification property at lower prices. A relatively unfavorable economic environment has also affected demand.”

“The price correction, however, presents a good opportunity for high-net-worth individuals to buy high-end properties at discounted prices,” Woodhams said.

READ:

Some 18% of Kenya’s high-net-worth individuals’ (HNWIs) – those with a net worth of US$1 million excluding their primary residences – bought new homes in the country in 2018, with only 8% purchasing houses abroad.

According to The Wealth Report Attitudes Survey, 22% of Kenya’s wealthy plan to buy new homes in the country in 2019/2020.

First and second homes make up 45% of total wealth for Kenya’s super-rich, with the HNWIs owning an average of 2.7 homes, according to The Wealth Report. Their South African counterparts own an average of four homes each.