NIC Group and Commercial Bank of Africa (CBA) Board of Directors have agreed to the merger of the two financial institutions to create the third-biggest bank in East Africa.

“We have a deal subject to the approval of the shareholders,” said Isaac Awuondo, Group Managing Director CBA.

“Our focus is really around our customers. Our expectations focus on customers will drive the future growth of the merged entity,” he added when spoke to investors at a briefing in Nairobi on Thursday.

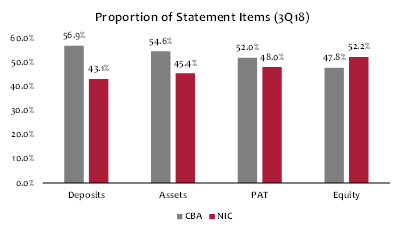

The proposed merger will be executed through a share swap. An exchange share ratio will be based on a 47:53 relative valuation of NIC and CBA respectively.

34 shareholders of CBA will exchange their shares in CBA for new shares in NIC, which will be the holding company of the merged business and remain publicly listed company on the Nairobi Securities Exchange.

The merged bank will have a combined asset base of Ksh 415 billion shillings and 9% of all loans in Kenya.

James Ndegwa, Chairman of NIC, said, “Our enhanced capacity through capital and balance sheet consolidation, as well as combined product and service capabilities, will make us the preferred partner to anyone doing business in East Africa and beyond. It also presents an attractive prospect to our shareholders as the strategic benefits from the merged entity materialise and financial synergies are delivered.”

Desterio A. Oyatsi, Chairman of CBA, said the merger presents an opportunity to play a critical role in the economies of the markets they operate in and the foundation to scale the business into other markets within Africa.

“Leveraging our core strengths of innovation which have delivered considerably to our financial inclusion agenda and enabled us to provide access to financial services to over 40 million customers in 5 markets. These are exciting times indeed, for our staff, our customers and shareholders.”

NIC aims to get shareholder approval in the first quarter of 2019, regulatory approval in the second quarter, and a formal merge in the third quarter, according to the NIC CEO John Gachora.

“We view this as great opportunity for potential investors based on our base case 0.9x P/B multiple, yielding a potential upside of 45.5% (TP: KES 42.33).,” said Genghis Capital. “The merger will see CBA shareholders receive 2.5 shares in the joint entity per CBA share held, implying a share swap of 2.5:1.”

Genghis Capital further note that given the joint entity will have increased market power and is expected to leverage on synergies, We don’t expect the counter to continue trading at heavily discounted multiples, as it is currently. However, the combined ROE underperforms its peers, and concerns still linger over the asset quality of NIC Group.”