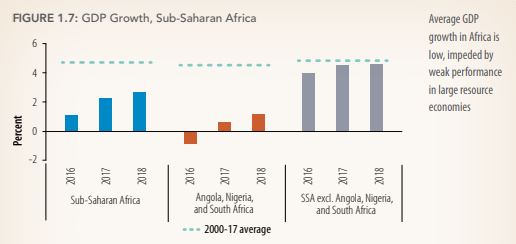

Economic growth in sub-Saharan Africa is slower than expected with the average rate estimated at 2.7 per cent in 2018 up from last year’s 2.3 per cent.

This is according to a World Bank findings that the sluggish expansion in the region’s three largest economies, Nigeria, Angola, and South Africa.

The report notes that the African region’s recovery from a slowdown in 2015-2016 is in progress but at a slower pace and more investments in non-resource sectors, jobs, efficient firms and workers are needed.

The report notes that the African region’s recovery from a slowdown in 2015-2016 is in progress but at a slower pace and more investments in non-resource sectors, jobs, efficient firms and workers are needed.

“Growth in the region is projected to increase from 2.7 percent in 2018 to 3.3 percent in 2019, rising to 3.6 percent in 2020, slightly below April forecasts.”

This will be reflected with a rebound in oil production in Nigeria and Angola however, economic activity in South Africa is expected to remain subdued, as high unemployment and slow credit growth weigh on household demand, and fiscal consolidation limits government spending.

According to Albert Zeufack, World Bank Chief Economist for Africa, “The region’s economic recovery is in progress but at a slower pace than expected. To accelerate and sustain an inclusive growth momentum, policymakers must continue to focus on investments that foster human capital, reduce resource misallocation and boost productivity. Policymakers in the region must equip themselves to manage new risks arising from changes in the composition of capital flows and debt.”

He said, “Slow growth is partially a reflection of a less favourable external environment for the region. Global trade and industrial activity lost momentum, as metals and agricultural prices fell due to concerns about trade tariffs and weakening demand prospects.

Countries such as Cote d’Ivoire, Kenya and Rwanda experienced good economic activity bolstered by a number of factors such as agricultural production and public investment.

The Kenya National of Bureau Statistics reported that the country’s Gross Domestic Product (GDP) grew by 6.3 per cent in the second quarter of 2018 compared to 4.7 per cent during a similar quarter in 2017.