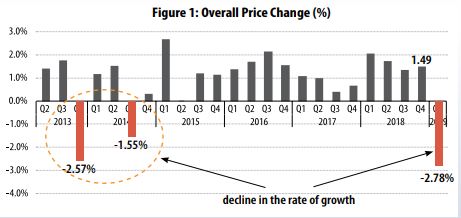

House prices in Kenya declined by 2.78% in the first quarter of 2019 according to the latest House Price Index (HPI) released by the Kenya Bankers Association. It was described as ‘the largest decline since 2013 base period’.

The decline is attributed to the constrained credit flows to both the supply and demand side of the housing market.

On the supply side, the Index associates the slowdown to a slump in the rate of credit growth to the building and construction sector between July 2017 and June 2018, which averaged at 1.2 percent.

“The influence of the credit supply to this sector, a good proxy of availability of funding for housing construction, manifested itself in supply constraints after a period of about a year,” noted KBA.

READ

- Outlook for Kenyan Real Estate Sector Remain Sluggish

- Real estate outlook across Kenya in 2019 hinges on the lifting of interest rate cap, and alternative finance models analysts say

“The price decline during the first quarter of 2019 while indicating the sustenance of a general trend observed since the second quarter of 2018 is seen as tentative, and could be a pointer to a depressed market if sustained,’’ KBA Research Director Jared Osoro said.

In addition, the volume of cement consumption also between July 2017 and November 2018 also dipped from 553,631 metric tonnes to 460,967, respectively.

On the demand side, among the factors highlighted as contributing to the decline include challenges facing prospective home buyers especially in accessing bank credit. Other factors cited include a cautionary stance of many households due to strained economic conditions and squeezed household budgets.

Although the price movements resonate with general stability recorded since the second Quarter of 2018, the new findings note that the stability is seen as tentative and could be a pointer to a depressed market if sustained.

In the report, apartments maintained dominance in the housing market accounting for

62.6 percent of the total units sold. “Even with the observed dominance, the share of apartments sold during the quarter reduced by 13.7% from 76.3% in the fourth quarter of 2018.”

READ:

The share of Maisonettes was up by 11.8% from 11.6% in the fourth quarter of 2018 to 23.4 percent in the first quarter of 2019.

On the other hand, the share of Bungalows marginally rose by 1.9% to account for 14.0 % of the house units sold in the market.