This content has been archived. It may no longer be relevant

The Finance Bill 2019 illustrates the Government priorities which include increasing revenue mobilization.

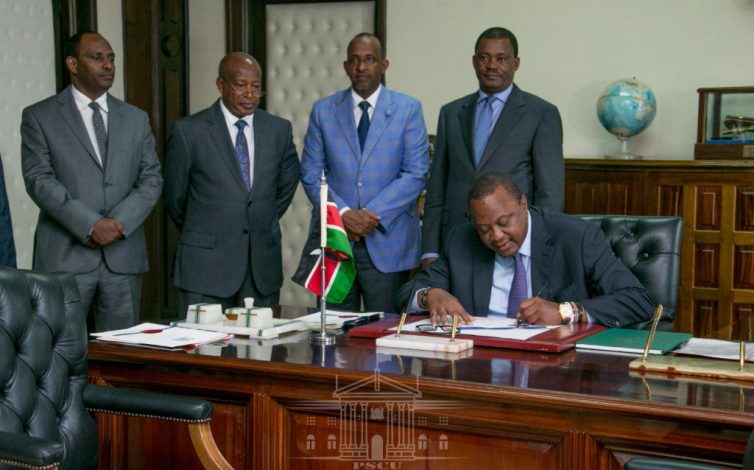

President Uhuru Kenyatta on Thursday assented to the Finance Bill 2019, a law that scraps capping of commercial lending rates.

The Act repealed section 33b of the Banking Act that provided for the capping of bank interest rates which had been blamed for stifling credit to the private sector.

“The repeal of section 33b of the Banking Act is expected to enhance access to credit by the private sector especially the Micro, Small and Medium Enterprises (MSMEs) as well as cut out exploitative shylocks and other unregulated lenders,” the State House said.

The amendment to the Finance Bill 2019 was passed by parliament on Tuesday after legislators opposed it failed to secure the required two-thirds majority. Only 161 members of parliament were present against the minimum of 233 members needed for a vote.

The Government published Finance Bill 2019 on 13 June 2019

Fortunately, existing loans will be shielded from an increase in interest rates, for the duration already agreed on between the lenders and borrowers.

On Tuesday, banks assured the public nothing will change once the rate cap was scrapped.

“For customers with higher risk profiles we may see a 2-3 percent increase,” Kenya Bankers Association (KBA) chairman and KCB Group chief executive Joshua Oigara said.

“The macroeconomic and business environment where we are today does not at all support an environment of high rates,” Oigara added.

Jibran Qureishi, regional economist for East Africa at Stanbic bank termed the repeal of the interest rate cap as ‘a positive move’ and will embolden commercial banks to price credit risk again and more importantly for SMEs.

READ: Kenyan Banks Told They Will Thrive If Credit is Extended to Medium Enterprises

“Finance Act 2019 seeks to yield an additional KES 37.0Bn (circa 1.7% of initial revenue estimates) in tax revenues in FY2019/20. Nonetheless, going forward, the Finance Bill will be submitted by late April as opposed to the current norm of mid-June (together with the budget statement). This is a positive step to avoid what has become a protracted legislative process. On the other hand, the Senate also approved to raise the debt ceiling to KES 9.0Tn, agreeing with the National Assembly. On the baseline, we view the debt ceiling hit in FY2023/24, although fiscal indiscipline poses a major risk,” commentary from Genghis Capital.

New Taxes

Tax to the Digital Space

The Finance Bill 2019 now introduces a tax on income raised from the digital marketplace as a measure of ensuring equity in taxation.

Personal Income Tax

Exemption of Income earned under Ajira Program whose aim is to bridge the gap between skills available and skills demand. The Government proposed that the youth registered for the program pay a registration fee of Ksh 10,000 for the next three years in lieu of income tax with effect from 1st January 2020.

Excise Goods Management System (EGMS)

The Kenya Revenue Authority (KRA) will implement the EGMS on bottled water, juices, energy drinks, soda, and other non-alcoholic beverages from November 13, 2019.

Other measures include an increase on excise duty rates for imported vehicles exceeding 1500cc to 25 percent, with that of diesel-powered ones above 3,000cc set at 35 percent.

Recovery of taxes upon failure to deduct or withhold

The Finance Bill 2019 has made a provision that allows for the Commissioner to recover taxes from a person who fails to deduct or withhold tax under the Law.

READ: