This content has been archived. It may no longer be relevant

The Competition Authority of Kenya has approved the acquisition of 93.57% of Transnational Bank’s shares by Access Bank PLC.

This will make Access Bank the third Nigerian lender to gain entry into the Kenya market after Guaranty Trust Bank Ltd. and the United Bank of Africa Plc.

In December 2018, Access bank entered into a strategic merger arrangement with Diamond Bank Plc expanding its retail footprint.

According to its 2018 annual report, the merger complemented the Bank’s existing corporate franchise to create a diversified bank that can support its customers’ needs.

It operates in 7 subsidiaries within West Africa, East Africa and the United Kingdom. The Bank also has business offices in the Republic of China, Lebanon, the United Arab Emirates, and India.

Transnational Bank Kenya Limited in the past has been reported losses.

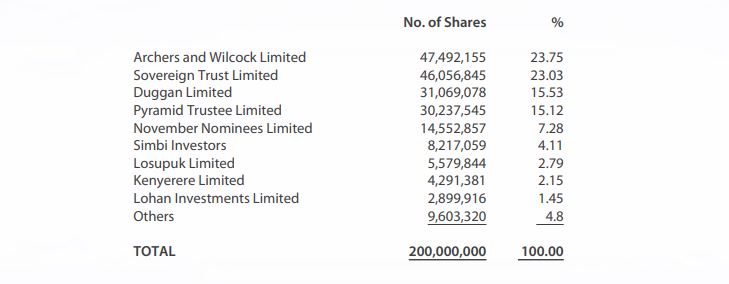

The bank’s s shareholders as of 31 December 2018 include Archers and Wilcock Ltd (23.75 percent), Sovereign Trust Ltd (23.03 percent), Duggan Ltd (15.53 percent), Pyramid Trustee Ltd (15.12 percent) and November Nominees Ltd (7.28 percent). Others are Simbi investors (4.11 percent), Losupuk Ltd (2.79 percent), Kanyerere Ltd (2.15 percent), and Lohan Investments Ltd (1.45 percent).

Cytonn Investments in its ‘Kenya Listed Banks H1’2019 Report’, it noted that consolidation and revenue diversification will become important for Kenya’s banking sector going forward.

According to Cytonn, “Consolidation has resulted in the successful remediation of collapsed banks and left fewer but well-capitalized players to be able to catalyse economic growth.”

In the past, the Central Bank of Kenya in its Financial Sector Stability report has said, “The benefits of banks consolidating include; improved resilience to shocks given higher capital buffers lower supervisory and compliant costs. The stability benefits of consolidation in the banking sector have informed mergers and acquisitions, especially after the liberalisation of the financial sector since 1990-2018.”

Kenya’s banking sector has witnessed an increased mergers and acquisition activity over the last 4 years.

NIC Group Plc and Commercial Bank of Africa Ltd completed its merger on 1st October 2019 to form NCBA Group Plc, a Non-Operating Holding Company.

KCB Group also acquired the National Bank of Kenya.

SBM Holdings Ltd. of Mauritius acquired some of the assets of Chase Bank Kenya Ltd through its subsidiary SBM Bank. In the acquisition, SBM Kenya took over 75 percent of the value of deposits under moratorium at CBLR, all non-moratorium deposits at CBLR, was taken up by over majority of CBLR branches and employees.

The remaining 25 percent of the value of moratorium deposits along with other assets and liabilities remains in CBLR.

SBM Kenya also acquired the entire capital of Fidelity Commercial Bank Ltd.