The ADI Foundation has partnered with M-PESA Africa, aiming to extend blockchain infrastructure to more than 66.2 million monthly users across eight African countries.

The collaboration will deploy ADI Chain in Kenya, DR Congo, Egypt, Ethiopia, Ghana, Lesotho, Mozambique, and Tanzania, creating institutional‑grade digital rails for individuals and small businesses.

Expanding Financial Access Through Blockchain

Since its 2007 launch in Kenya, M-PESA has transformed financial inclusion by enabling millions to access services via mobile devices, bypassing traditional banking barriers. The new partnership builds on this foundation by integrating blockchain capabilities into M-PESA’s infrastructure, which already processes $309 billion annually.

“M-PESA has been amazing in terms of financial inclusion,” said Huy Nguyen Trieu, council member on the ADI Foundation’s board of advisers. “Our view is that we can push it further again by providing the right digital infrastructure, both for individuals and SMEs. The foundation’s infrastructure can act as the building blocks to accelerate digital transformation.”

Kenya’s Stablecoin Surge

Kenya processed $3.3 billion in stablecoin transactions in the 12 months ending June 2024, according to Chainalysis, making it the fourth‑largest recipient in Africa behind Nigeria, South Africa, and Ghana. In addition, Kenya now ranks fifth globally for stablecoin use, outpacing major economies such as the United Kingdom, India, and Indonesia.

Stablecoins are proving far more cost‑effective than traditional remittances, with transaction costs 85% cheaper. This efficiency has driven adoption for everyday financial needs: diaspora remittances, cross‑border trade settlements, freelancer payments, and hedging against currency volatility.

According to Triple‑A estimates, 10.71% of Kenya’s population—nearly 6.1 million people—currently hold cryptocurrencies. These are not speculative trades but practical tools for financial resilience.

Market Demand for Digital Assets

African markets have shown strong appetite for digital asset infrastructure. Nigeria’s Securities and Exchange Commission reported $50 billion in crypto transactions during the 12 months ending June 2024.

Chainalysis also documented significant stablecoin usage in cross‑border commerce, particularly in energy sector transactions and merchant settlements between Africa, the Middle East, and Asia.

M-PESA’s established mobile money network provides a ready foundation for blockchain integration, enabling new services such as stablecoin transactions, cross‑border payments, and digital asset access.

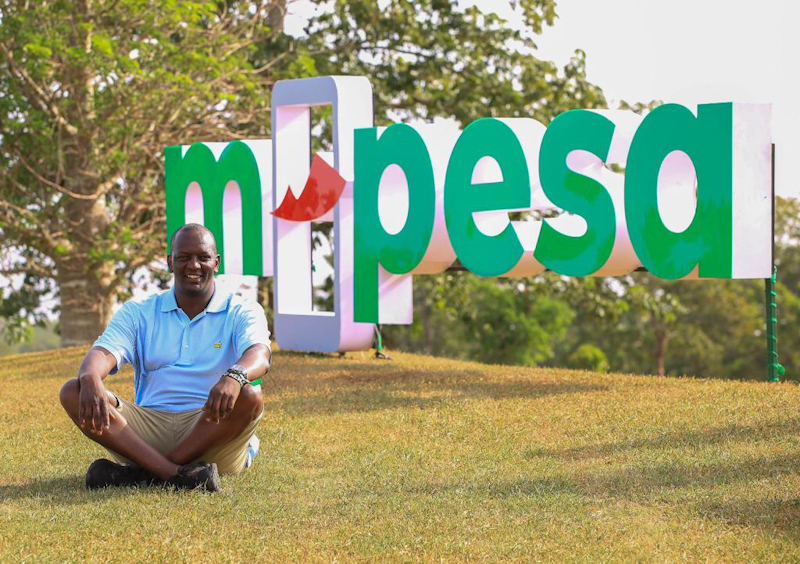

“We are excited to partner with ADI Foundation to tap into their expertise around new technologies and how these can transform financial services,” said Sitoyo Lopokoiyit, CEO of M-PESA Africa.

Strategic Focus on Africa

This partnership represents ADI Foundation’s most significant African engagement to date. Nguyen Trieu confirmed that African users will form a major segment of the foundation’s ambition to onboard one billion people to blockchain by 2030.

With 42% of adults in sub‑Saharan Africa unbanked, blockchain infrastructure offers a pathway to financial inclusion. Stablecoins, pegged to the US dollar, are particularly attractive for hedging against currency volatility. Mobile money platforms like M-PESA have already proven their ability to reach populations excluded from traditional banking.

Institutional-Grade Infrastructure

ADI Chain addresses barriers to institutional blockchain adoption in Africa by embedding regulatory compliance, operating within existing payment rails, and meeting government security standards. This ensures institutions can deploy blockchain without compromising sovereignty or control.

The network will also support cross‑border payment settlement for Abu Dhabi‑based enterprises via a dirham‑backed stablecoin, expected in early 2026.

ADI Foundation currently maintains partnerships across 20 countries, with more than 50 institutional, enterprise, and government projects preparing to deploy on the network.

Technical Foundation

ADI Chain’s architecture is built on three principles: compliance, efficiency, and security. It incorporates ZKsync’s Airbender technology, marking the first production deployment of this zero‑knowledge proof system. Infrastructure partners include Alchemy (RPC and data services), WalletConnect (wallet‑to‑application connectivity), and Covalent(blockchain data indexing).

First Abu Dhabi Bank and IHC will issue a UAE dirham‑backed stablecoin under UAE Central Bank oversight, creating a compliance blueprint for mobile money platforms evaluating blockchain integration.

Established by Sirius International Holding in December 2024, the ADI Foundation operates from Abu Dhabi with a mandate to build government‑grade blockchain systems tailored to emerging markets. The M-Pesa partnership demonstrates how mobile money platforms with proven reach can integrate blockchain to deliver cross‑border settlement, stablecoin transactions, and expanded digital financial services.

Kenya’s crypto surge—driven by $3.3 billion in stablecoin transactions and adoption by over 6 million citizens—shows the scale of demand. With M-Pesa’s reach and ADI’s infrastructure, Africa is poised to become a global leader in blockchain‑enabled financial markets.