The average interbank rate dropped to 3.5% in the month of January from 8.0% in December attributed to improved liquidity and support by government payments and debt redemptions.

“The money market remained liquid during the week ending January 31, mainly supported by government payments,” Data from the Central Bank of Kenya (CBK).

During the week ( Jan 28 – Feb 1), the average interbank rate rose to 4.6%, from 3.2% the previous week, while the average volumes traded in the interbank market declined by 83.2% to Kshs 2.5 bn from Kshs 14.8 bn the previous week.

Genghis Capital Analysts said the uptick in the average money market rate against the high liquidity cements the market segmentation which has tilted against Tier III players. The regulator largely kept from intervening in the market during the week.

Genghis Capital Analysts said the uptick in the average money market rate against the high liquidity cements the market segmentation which has tilted against Tier III players. The regulator largely kept from intervening in the market during the week.

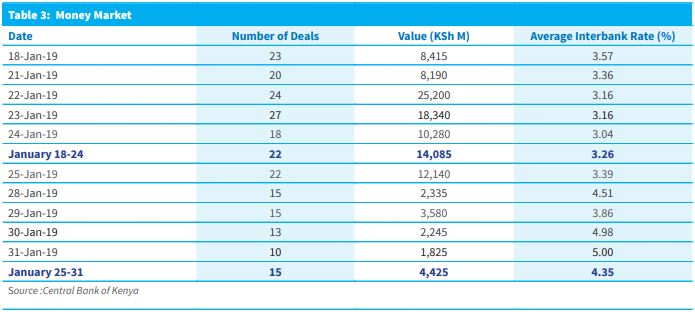

Commercial banks’ excess reserves stood at KSh 23.9 billion in relation to the 5.25% cash reserves requirement (CRR). The interbank rate increased to 5.00 percent on January 31 from 3.04 percent on January 24.

The average number of interbank deals decreased to 15 compared to 22 in the previous week while the average volume traded decreased to KSh 4.4 billion from KSh 14.1 billion.