Kenya’s total receipts for the August period of the current fiscal surged 34 per cent, to Ksh 125.3 billion compared to Ksh 93.5 billion similar period in FY 2020/21.

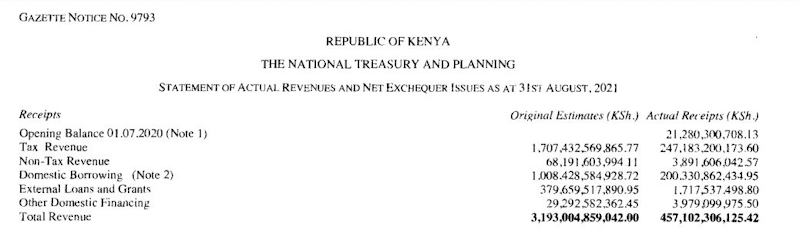

According to the statement of actual revenues and net exchequer issues as of August 31 by the National Treasury, published Friday, cumulative tax receipts through the first two months of the 2021/22 financial year stand at Ksh 247.2 billion in contrast to Ksh188.1 billion in August 2020.

This is a 23 per cent increase attributed to both the economic recovery on easing of the Covid-19 containment measures.

Additionally, the implementation of the Finance Act 2021 brought changes to the Excise Duty Tax, Income Tax as well as Value Added Tax aimed at enhancing revenue collection.

In the statement, Treasury’s cumulative non-tax revenues in the period stand at Ksh 3.9 billion.

Consequently, the government has borrowed Ksh 200.3 billion from the domestic credit market and Ksh 1.7 billion externally.

By the end of August, the government was 33.8 per cent ahead of its prorated borrowing target of Kshs 126.6 billion having borrowed Kshs 169.5 billion of the Kshs 658.5 billion borrowings for the FY’2021/2022.

Treasury projects its fiscal deficit at 7.5 per cent of the gross domestic product (GDP) for the fiscal year 21/22.

“We expect a gradual economic recovery going into FY’2021/2022 as evidenced by the Kenya Revenue Authority July collections of Kshs 267.1 billion compared to the monthly prorated amount of Kshs 266.0 billion,” Cytonn Investments noted in its August report.

Cytonn also noted that despite the projected high budget deficit and the lower credit rating from S&P Global to ‘B’ from ‘B+’, they believe that the monetary support from the IMF and World Bank will mean that the interest rate environment may stabilize since the government will not be desperate for cash.