Kenya’s biggest bank group KCB on Thursday reported a rise in consolidated net profit at Ksh 15.3 billion for the first six months to June 30.

The lender had posted a net profit of Ksh 7.6 billion in the corresponding previous fiscal year.

Revenues increased by 14 per cent to KSh 51.2 billion on account of higher interest income driven by an increase in earning assets and lower cost of funding.

“We saw a strong first half of the year for the business with improved economic activity. The resilient and diversified nature of our business has helped us navigate the unfolding impact of the Covid-19 pandemic,” said KCB Group chief executive Joshua Oigara at an investor briefing on Thursday.

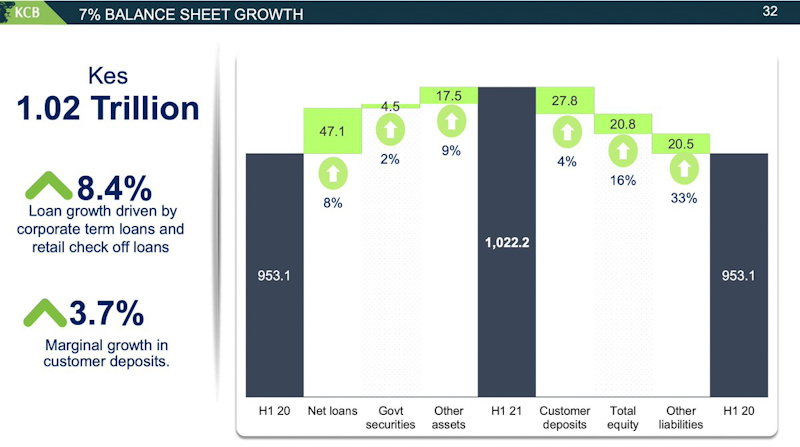

KCB Group’s loan book grew to KSh606.9 billion in June this year, from KSh559.8 billion in the first half of last year.

Customer deposits grew from KSh758.2 billion to KSh786 billion in a similar period.

The lender which also operates in Uganda, Tanzania, Rwanda, Burundi and South Sudan said its balance sheet grew 7 per cent during the half-year period to reach Kshs. 1.02 trillion from Ksh 953 billion, becoming the second bank in Kenya after Equity Group to have one trillion in total assets.

The bank is in the process of acquiring subsidiaries in Rwanda and Tanzania and as a result, KCB group will not pay an interim dividend for the half-year period that ended on 30th June 2021.