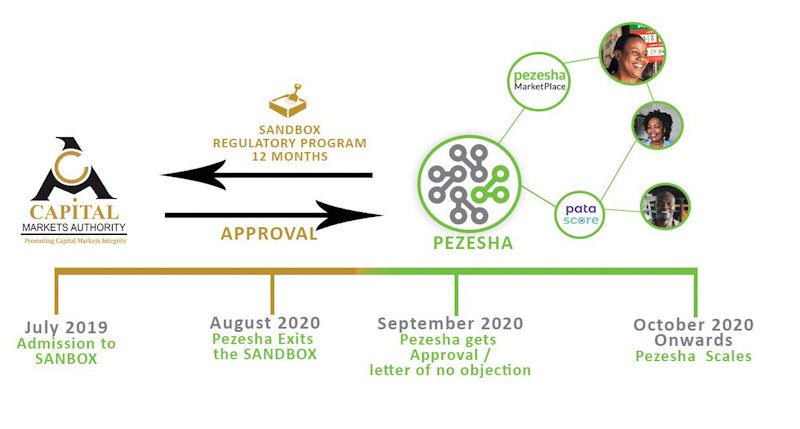

The Capital Markets Authority (CMA) has granted a ‘No Objection’ to Pezesha Africa Limited, a secure Peer to Peer marketplace platform to operate its debt-based crowdfunding platform in the Kenyan capital markets.

This follows a successful one-year testing period in the Regulatory Sandbox, which was launched in March 2019.

A Crowdfunding Platform is a website that allows firms and entrepreneurs to raise and collect funds from investors, contributors and donors.

The No Objection has been issued subject to Pezesha’s maintenance of existing compliance requirements including; an appropriate financial risk management framework, adequate local capital market transaction control procedures and efficient, orderly, and fair operations of the business segment, product or intermediaries.

However, this is subject to the finalization of a Comprehensive Regulatory Framework to operate a Debt-Based Crowdfunding Platform in Kenya’ in the medium term.

The CMA Acting Chief Executive Wyckliffe Shamiah, said; ‘‘This positive outcome is a clear demonstration of the unique opportunities arising from the sandbox environment and potential for scaling up innovative ideas. ’, The success of Pezesha’s testing phase underlines the Authority recognition of the need to nurture innovations that can transform the fundraising model in the capital markets.”

“The ‘No Objection’ is timely given the impact of Covid-19 on the economy. At Pezesha, we believe the approval highlights our commitment to build trust of all key stakeholders within our digital ecosystem and the capital markets. Our goal is to introduce innovative products for investors aimed at providing SMEs access to capital. We will do this by maintaining the highest standards of governance, and transparency as we continually derisk the value-chain for all stakeholders. We are excited about this new phase of our company’s growth’’, said Pezesha Chief Executive Officer, Hilda Moraa.

Alternative capital raising initiatives including crowdfunding platforms provide a different way to raise funding for large companies, small enterprises, and retail borrowers through equity, debt, or a hybrid model.

To ensure the development of a robust, facilitative, and responsive policy and regulatory framework for crowdfunding in Kenya, CMA is firmly committed to review and adopt global best standards and monitor the growth and activities of the crowdfunding space in Kenya.

This will ensure prudent management of investor funds and risk mitigation as well as ensure the efficient, orderly, and fair operation of this segment and players.