This content has been archived. It may no longer be relevant

Absa Bank Kenya PLC borrowed KSh 2.6 billion loan from Absa Group to help mitigate the capital and cash flow impact of the separation costs according to its 2019 annual report.

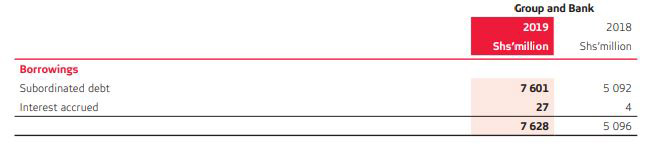

“The $25 million (KSh2.6 billion) subordinated loan from Absa Group Limited was obtained on October 16, 2019, and has a maturity date of October 16, 2029,” Absa Kenya disclosed in its Notes to the annual financial statements for the reporting period ended 31 December.

“Interest is paid quarterly in arrears at a rate of 2.7 percentage points above USD Libor which re-sets every three months. No collateral is held against the borrowings.”

As a result, the lender’s capital to KSh7.6 billion in the year ended December 2019 compared to KSh5 billion the year before.

It further disclosed that the Group did not have any defaults of principal or interest or other breaches with respect to its subordinated liabilities during the years ended 31 December 2019 and 2018.

Barclays PLC reduced its shareholding in Absa Group Limited, the parent company of Absa Bank Kenya PLC, from 62.3% to 14.9% in 2016/2017.

According to Yusuf Omari Chief Financial Officer Absa Kenya, the separation from Barclays PLC is expected to continue having an impact on their financial results for the next few years. This includes a substantial change spend, as the lender invest in the systems required to be separated from Barclays PLC, the Transitional Service, Agreement costs being paid to Barclays PLC for provision of various services during the separation, and depreciation and amortisation of any intangibles.

“Our Holding company Absa Group Limited (AGL) will provide capital support to help mitigate the capital and cash flow impact of the separation costs over time.

We will provide normalised financials results to adjust for the consequences of Separation and to better reflect our underlying performance, and to inform our capital and dividend decisions,” he says.